If you’re running a subscription business, one metric stands above all others: Monthly Recurring Revenue (MRR). Think of it as the predictable, steady heartbeat of your company. It’s the income you can confidently expect to bring in every single month from all your active customer subscriptions.

For any SaaS company, MRR isn’t just a number—it’s the financial lifeblood. It gives you a clear, reliable snapshot of your financial health and is the single most important indicator of your growth potential.

The Foundation of Subscription Business Health

Let’s try a simple analogy. Imagine your company’s revenue stream is a river. One-off sales are like sudden rainstorms—they can create a big gush of water, but it’s temporary and unpredictable. MRR, on the other hand, is the consistent, reliable current that keeps that river flowing, day in and day out. It’s this stability that makes it the North Star for subscription-based businesses.

Tracking MRR allows you to stop reacting to chaotic sales numbers and start forecasting the future with a real sense of confidence. When you know your MRR, you can make smarter decisions about everything.

- Budgeting: You can hire new team members, launch a marketing campaign, or invest in product development because you have a clear picture of your baseline income.

- Strategic Planning: Forget guesswork. You can set realistic growth targets and build a long-term roadmap based on solid financial footing.

- Investor Confidence: A healthy, growing MRR is exactly what investors want to see. It proves you have a scalable and sustainable business model.

What MRR Actually Measures

So, what are we really tracking when we look at MRR? It’s not just your total sales for the month. It’s all about predictability. MRR is calculated by taking the value of all your active subscription contracts and normalizing them into a monthly amount. This is a crucial distinction because it deliberately filters out all the financial “noise” that can give you a false sense of security.

By focusing only on the recurring parts of your revenue, MRR paints a clear, uninflated picture of your company’s sustainable income. It answers the most fundamental question for any subscription business: “How much money can we count on next month, just from the customers we have right now?”

This is why things like one-time setup fees, consulting services, or overage charges aren’t included in MRR. While that income is great, it’s not predictable. It doesn’t tell you anything about the underlying health of your subscription base. Keeping those separate is key to building a resilient business you can truly scale.

How to Calculate Your Basic MRR

Figuring out your Monthly Recurring Revenue is a lot simpler than it sounds. You’re not trying to do complex accounting here; the goal is to get a reliable pulse on your predictable income.

The most straightforward way to get started is with a simple formula:

Total Number of Active Customers x Average Revenue Per Customer

So, if you have 100 active customers, and on average they each pay you $50 a month, your basic MRR is $5,000. It’s a clean number that tells you, all things staying the same, you can count on $5,000 coming in next month.

Let’s Walk Through an Example

Imagine a small SaaS company, “SyncUp,” that sells project management software. They keep their pricing simple with two plans:

- Basic Plan: $20 per month

- Pro Plan: $50 per month

At the end of the month, they check their numbers. They have 80 customers on the Basic Plan and 30 on the Pro Plan.

To get their MRR, they just need to add up the revenue from each plan:

- First, the Basic Plan: 80 customers × $20/month = $1,600

- Next, the Pro Plan: 30 customers × $50/month = $1,500

Then, they just add the two together.

$1,600 (Basic) + $1,500 (Pro) = $3,100 MRR

That $3,100 is their baseline. It’s the predictable revenue they can use for budgeting, forecasting, and deciding where to invest in growth next.

What to Include and What to Leave Out

Getting your MRR calculation right is all about what you choose to include. The golden rule? Only count predictable, recurring subscription payments. Think of it as the core, reliable income your business generates month after month. For a deeper dive, Consero Global offers some great insights on the nuances of this calculation.

Key Takeaway: Your MRR figure is only as good as what you put into it. Keep it pure—stick to predictable subscription revenue and leave out any one-time cash injections.

Here’s a quick list of what you should always filter out:

- One-time setup fees: They’re a nice bonus, but they aren’t recurring, so they don’t belong in MRR.

- Variable usage charges: Things like extra API calls or overage fees are unpredictable and will skew your numbers.

- Consulting or training fees: These are one-off services, not part of the core subscription product.

The Hidden Story Behind Different MRR Types

Your total MRR gives you a fantastic 30,000-foot view of your business, but the real story is in the details. To truly get a handle on your growth trajectory, you have to break that big number down. Think of it like a car’s dashboard: the speedometer is great for showing your current speed, but you also need the fuel gauge and engine temperature to know if you’re actually going to make it to your destination.

Breaking down MRR reveals the “why” behind your revenue. It tells you exactly where growth is coming from, where you’re bleeding cash, and which levers to pull to make your business healthier and more predictable.

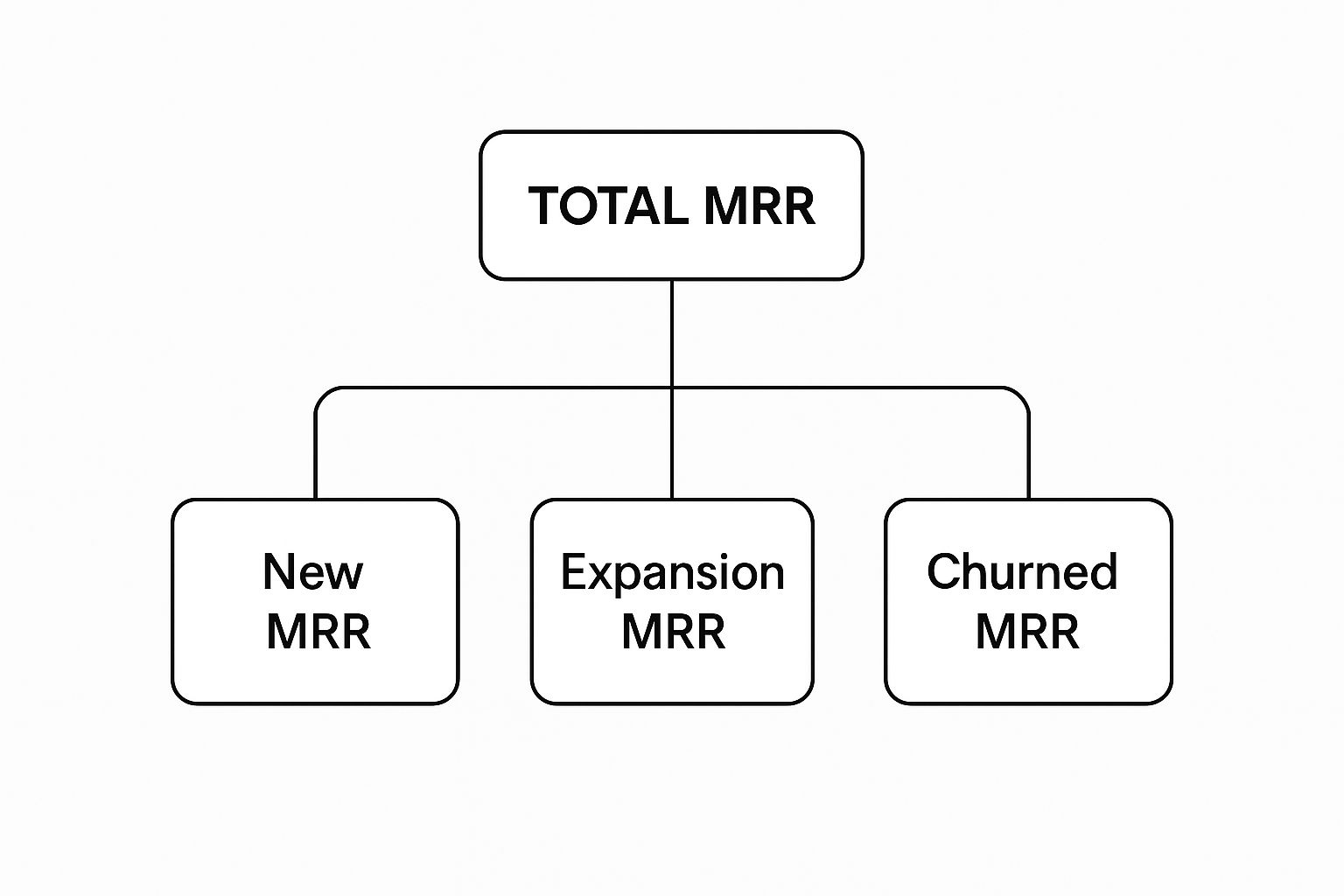

This diagram shows how these different components flow together to create your total MRR.

As you can see, your total MRR isn’t a single, monolithic number. It’s a dynamic mix of new business wins, growth from your existing customers, and the inevitable losses from churn.

To really dig in, let’s look at what each of these components tells you about the health of your SaaS business. The following table breaks down the key types of MRR, what they measure, and why they matter.

Understanding MRR Components

| MRR Type | What It Measures | Business Implication |

|---|---|---|

| New MRR | Revenue from brand-new customers acquired this month. | This is a direct measure of your sales and marketing effectiveness. It’s the engine of new growth. |

| Expansion MRR | Additional revenue from existing customers (upgrades, add-ons). | A strong signal of product value and customer satisfaction. It shows your product is “sticky.” |

| Churned MRR | Revenue lost from customers who cancel or downgrade. | This is the “leaky bucket” in your business. High churn can silently kill your growth. |

Each of these metrics provides a unique window into your business, helping you pinpoint what’s working and what needs immediate attention.

New MRR: The Engine of Acquisition

New MRR is the most straightforward piece of the puzzle. It’s the total recurring revenue you brought in from customers who had never paid you before this month. If you sign up 10 new customers on a $100/month plan, you’ve just added $1,000 in New MRR. Simple.

This metric is a direct report card on your sales and marketing efforts. A healthy, growing New MRR number means your message is resonating and you’re successfully converting leads into paying customers. It’s the primary fuel for expansion, especially when you’re in the early stages and fighting for market share.

But here’s the catch: relying only on New MRR for growth is an expensive and exhausting game. Which brings us to a much more efficient way to grow.

Expansion MRR: The Secret to Sustainable Growth

Expansion MRR (sometimes called Upgrade MRR) is the extra monthly revenue you generate from the customers you already have. It’s pure gold.

This growth typically comes from three places:

- Upgrades: A customer moves from your “Basic” plan to your “Pro” plan.

- Cross-sells: A customer on your marketing tool buys your new sales analytics product.

- Add-ons: A customer adds more user seats, buys more storage, or increases their API call limit.

Expansion MRR is one of the most powerful indicators of a healthy business. It proves your customers are not just sticking around, but are getting so much value that they’re willing to pay you more over time. For many mature SaaS companies, expansion revenue becomes the main driver of growth, even outpacing new customer acquisition.

Key Insight: It’s almost always cheaper and easier to sell more to an existing customer than it is to acquire a brand new one. Focusing on Expansion MRR is one of the most efficient growth hacks in the SaaS playbook.

Churned MRR: The Revenue Leak You Must Plug

Finally, we have the one nobody likes to talk about: Churned MRR. This is the recurring revenue you lose each month when customers cancel their subscriptions or downgrade to a cheaper plan. If five customers on a $50/month plan cancel, you’ve lost $250 in Churned MRR.

This is the anti-growth metric. It actively works against all your hard-earned progress from New and Expansion MRR.

Think of it as a leaky bucket. You can pour as much water in as you want (New MRR), but if you don’t plug the holes (Churned MRR), you’ll never fill it up. Keeping a close eye on churn is absolutely critical for spotting problems with your product, onboarding, or customer support before they spiral out of control.

Why MRR Is Your Most Important Growth Metric

While the different flavors of MRR show you how your business is growing, the total MRR figure itself is the reason growth is even possible. For any SaaS or subscription company, MRR is more than just another number on a dashboard; it’s the compass for your entire operation.

What’s its superpower? In a word: predictability.

Unlike the rollercoaster of one-time sales, recurring revenue gives you a stable baseline of income you can count on. That stability completely changes how you run your business. You can stop reacting to the chaotic ups and downs of monthly sales and start planning for the future with real confidence. This predictable cash flow is the bedrock of every sustainable company.

And this isn’t some niche trend—it’s a massive economic shift. The subscription economy has exploded by an incredible 435% over the last decade, and it’s on track to hit a $1.5 trillion market value by 2025. Subscription companies are growing 4.6 times faster than S&P 500 businesses, which makes MRR the vital sign of modern business health. You can discover more about recurring revenue statistics to get the full story.

MRR Drives Smarter Business Decisions

A firm grip on your MRR turns risky gambles into calculated, strategic moves. When you know what’s coming in the door each month, you can allocate resources and map out your growth with a clear head.

This clarity ripples through every department:

- Budgeting and Hiring: You can greenlight that new hire, expand a department’s budget, or sign up for a new tool because you’re working with a reliable financial forecast, not just a guess.

- Marketing and Sales: It allows you to set aggressive but realistic targets. You can confidently invest in new campaigns, knowing you have the revenue to back them up.

- Product Development: You can fund new features and long-term improvements from a solid financial foundation, rather than being limited by this month’s cash flow.

To an investor, a steadily growing MRR is the single best indicator of a healthy, scalable business. It’s hard proof that your product works, your customers are sticking around, and your company is a far less risky bet.

A Foundation for Long-Term Success

At the end of the day, MRR isn’t just about money. It’s about building a resilient company that can weather any storm. It forces you to zero in on the one thing that truly guarantees long-term success: your customer relationships.

A healthy MRR is the direct result of delivering so much value that your customers can’t imagine leaving. It reflects customer satisfaction and loyalty in a way a one-off purchase never could. By tracking and working to improve MRR, you are fundamentally focused on making your product better and your customer bonds stronger.

That obsession with retention and value is what separates fleeting startups from companies that last.

How MRR Connects to Other Key SaaS Metrics

Monthly Recurring Revenue is a powerful number, but it never tells the whole story on its own. It’s better to think of it as the sun in your business’s solar system—everything else revolves around it and is affected by its gravitational pull.

To get a true read on your company’s health, you have to see how MRR interacts with other vital SaaS metrics. This interconnected view helps you make smarter decisions that lead to sustainable growth, rather than just chasing one number up a chart.

The Relationship Between MRR and ARR

The closest relative to MRR is Annual Recurring Revenue (ARR). If MRR is your monthly pulse, ARR is your yearly physical. It shows the predictable revenue from all your subscriptions over a 12-month period, giving you a much longer-term view of your financial stability.

The math is usually pretty simple: ARR is just your MRR multiplied by 12. Businesses that focus on annual contracts often lean more heavily on ARR because it lines up better with their sales cycles and financial planning. This simple connection is the bedrock of the subscription economy, a market projected to hit USD 10.77 billion globally by 2025. You can discover more insights about ARR and its market impact to see just how big this is.

Connecting MRR to Customer Value and Cost

This is where things get really interesting. MRR is the key that unlocks two of the most important metrics in any SaaS business: Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC). LTV estimates the total revenue you’ll earn from a customer over their entire relationship with you, while CAC tells you exactly what you paid to get them in the door.

MRR is a core building block for LTV. All else being equal, a higher MRR from a customer means a higher lifetime value. The magic ratio every healthy SaaS business chases is an LTV that is at least 3x its CAC. This 3:1 ratio means for every dollar you spend acquiring a customer, you get three dollars back over time. A strong, growing MRR is what makes achieving this profitable balance possible. If you want to dig deeper, we have a complete guide on how to calculate SaaS Customer Acquisition Cost.

Key Takeaway: A healthy MRR is the engine that drives a profitable LTV-to-CAC ratio. Without predictable monthly income, you can’t sustainably invest in acquiring new customers.

Finally, there’s the metric that actively works against your MRR: churn. Customer churn is simply the rate at which your customers cancel their subscriptions. Every time a customer leaves, they take a chunk of your MRR with them. This is why tracking churn alongside MRR is so critical—it shows you just how crucial customer retention is for building a business that doesn’t just survive, but thrives.

Practical Ways to Increase Your MRR

Alright, so you know what MRR is and how to calculate it. That’s a great start, but it’s only half the story. Now comes the fun part: making that number grow.

When you boil it all down, increasing your MRR really comes down to mastering three things: getting new customers, earning more from the customers you already have, and, just as importantly, keeping them from leaving.

Think of these as the three legs of a stool. If you focus on all three, you build a stable, sustainable business that can weather just about anything.

Attract More Customers

The most straightforward way to pump up your MRR is simply to sign up more people. This means your sales and marketing machine needs to be running smoothly, turning interested prospects into happy, paying customers.

If your funnel has leaks and potential customers are dropping off along the way, you’re leaving money on the table.

You need a solid plan for bringing people in. That might mean creating helpful content, running targeted ad campaigns, or building an outbound sales team. Whatever your method, the goal is the same: generate good leads. For a much deeper dive, check out our guide on B2B SaaS lead generation. A steady flow of new sign-ups is the fuel for your New MRR.

Increase Your Expansion MRR

One of the most powerful, yet often overlooked, ways to grow is to increase the revenue you’re already getting from your current customers. This is what we call Expansion MRR, and it’s incredibly valuable because you don’t have to spend a dime on acquiring these customers—you already have them!

There are a few classic ways to drive expansion revenue:

- Upselling: Persuade happy customers to move up to a more premium plan with more powerful features.

- Cross-selling: Offer a related product or service that solves another one of their problems.

- Add-ons: Sell things like extra user seats, more storage, or priority support to their existing plan.

Focusing on expansion is a massive vote of confidence for your product. When customers are willing to spend more money with you over time, it’s the ultimate signal that you’re delivering real value and have created something they can’t live without.

Reduce Customer Churn

Last but certainly not least, you have to protect the revenue you’ve worked so hard to build. Churned MRR—the revenue you lose when a customer cancels—is a silent killer of growth. High churn can undo all of your hard work in sales and marketing.

So, how do you keep customers around?

Start with an amazing onboarding process that helps them get that “aha!” moment as quickly as possible. Be proactive with your customer support, solving small issues before they become big frustrations. And above all, listen to what your customers are telling you and use that feedback to make your product better.

Plugging the leaks in your bucket is just as crucial as pouring more water in.

Common MRR Questions Answered

Even when you’ve got a handle on the basics of monthly recurring revenue, a few practical questions always seem to pop up. Let’s walk through the most common ones so you’re crystal clear on the details.

Should One-Time Payments Be Included in MRR?

Nope. Absolutely not. This is probably the most important rule to remember when calculating MRR.

Any one-time charges—think setup fees, consulting projects, or hardware sales—have to be kept separate. MRR is all about tracking predictable, recurring income. Tossing in one-off payments will only inflate your numbers and give you a misleading picture of your company’s stable, ongoing revenue.

How Is MRR Different from Revenue?

It helps to think of it like this: all your MRR is revenue, but not all of your revenue is MRR.

Revenue is the big picture. It’s the total income your business earns in a given period, which can include everything from subscriptions to one-time professional services.

MRR, on the other hand, zooms in on only the predictable subscription income. It smooths everything out into a consistent monthly number.

This also separates it from “bookings,” which is the total value of new contracts you sign. A customer might pay for a full year upfront (a booking), but MRR would break that lump sum down into twelve equal monthly payments.

What Is a Good MRR Growth Rate?

There’s no single magic number here—what’s considered “good” really depends on where your company is in its journey.

For early-stage startups, a month-over-month growth rate of 15-20% is often the goal. It shows you’ve found a real market need and are gaining traction fast. Once a company gets bigger and the MRR base grows, a healthy rate might look more like 5-10% per month.

The real goal is to keep growth consistent while keeping churn low. One of the best ways to fight churn is to nail your user experience right from the start. Diving into some SaaS onboarding best practices is a great way to learn how to keep new customers happy and engaged.