So, you have a brilliant idea for a startup. That's a fantastic start, but let's be honest—passion alone doesn't build a successful business. Before you go all-in, you need to answer the single most important question: Will anyone actually pay for this? This is the essence of market research, and for a startup, it's less of a "nice-to-have" and more of a "do-or-die" first step.

Why Market Research Is Your First Big Test

The "if you build it, they will come" mindset is a romantic notion that has tanked more startups than you can count. So many founders get caught up in the excitement of their solution, they forget to make sure they're solving a real, painful problem. This isn't just a small oversight; it's the number one reason new businesses go belly-up.

Market research is your reality check. It forces you to step outside your own head and confront the facts, even if they're not what you want to hear.

The point isn't to find data that confirms your biases. The real gold is in discovering what you didn't even know you didn't know. That's where true insight lives.

Think of it this way: solid research is your best defense against burning through your savings and your sanity. It’s all about proving there’s a paying audience before you spend a dime on development or a single minute writing code.

The High Cost of Guessing

Skipping market research isn't just risky; it's a gamble you can't afford to lose. The startup graveyard is filled with beautifully engineered products that no one ever wanted. These companies solved problems that were merely annoying, not agonizing, or they targeted customers who simply weren't willing to open their wallets.

The numbers don't lie. A staggering 42% of startup failures happen because they misjudged market demand. It’s the leading cause of death for new ventures. When you consider that around 90% of all startups fail, choosing to ignore research is like trying to cross a minefield with a blindfold on. According to a study on driveresearch.com, founders who prioritize validated learning dramatically increase their odds.

Moving From a Hunch to a Real Problem

Good market research is what transforms your fuzzy idea into a clearly defined, validated customer problem. You stop thinking, "People need a better way to manage projects," and start discovering that "Freelance graphic designers are losing 10 hours a month chasing client feedback and will gladly pay for a tool to fix that."

Getting that specific is what separates the winners from the "almosts." It gives you the clarity to:

- Carve Out Your Niche: Find a small, underserved corner of the market you can dominate.

- Sharpen Your Message: Create a value proposition that hits on a real, urgent pain point.

- Know Your Enemy: Understand who you're really competing against and what makes you different. A thorough competitor landscape analysis is non-negotiable here.

In the end, market research isn't some boring, academic task you have to get through. It's a living, breathing conversation with the people who will one day become your customers. It’s the crucial process that turns a founder's dream into a business with a genuine shot at making it.

Figuring Out What You Need to Know and Who to Ask

Before you do anything else, you need a plan. Diving into research without a clear direction is like driving without a map—you’ll burn through time and money and get completely lost. So, the first real step is to pin down exactly what questions you need answers to and who you'll be asking.

This is where you turn those big, fuzzy ideas floating around in your head into sharp, focused objectives. If you skip this, you’ll end up with a pile of interesting but ultimately useless data. The goal here is to move from broad curiosity to specific, testable assumptions about your business.

Setting Clear, Actionable Research Goals

Your first job is to get specific. A vague goal like, "Find out if people want my app," won't get you anywhere. You need to frame your goals as precise questions that can be answered with real data.

Think about the biggest "leaps of faith" your business idea relies on. These are the core assumptions that, if wrong, could sink your entire startup. Your research should be designed to prove or disprove these assumptions as quickly and cheaply as possible.

Here's how to turn a vague thought into a sharp, researchable objective:

-

Vague Idea: "I wonder if businesses need another project management tool."

-

Sharp Objective: "Are freelance graphic designers willing to pay $30 per month for a tool that automates client feedback and approval?"

-

Vague Idea: "My app helps people find cool local events."

-

Sharp Objective: "Will college students in a city like Austin use a new app at least three times per week to discover non-university-sponsored events?"

See the difference? This forces you to think about critical details like your price point, your exact user, and how they'll actually use your product. This is ground zero for figuring out how to do market research that actually matters.

Getting Specific About Your Target Customer

Once you know what you're asking, you need to decide who you're asking. And "millennials" or "small business owners" just isn't going to cut it. That’s far too broad. You need to build out detailed customer personas.

These personas go way beyond basic demographics like age and location. They should be rich, almost story-like profiles that dig into the psychographics of your ideal customer—what are their goals, biggest frustrations, daily routines, and motivations?

A great persona makes your target customer feel like a real person. It gives your whole team a shared understanding of who you're building for, helping you create a solution they’ll genuinely need and, more importantly, be willing to pay for.

For a new startup, this deep level of empathy is what separates a "nice-to-have" product from a "must-have" solution. If you need a hand getting started, this guide on how to create buyer personas is a fantastic resource.

Let's go back to that project management tool idea. You might think you're targeting "creatives," but two very different personas could exist under that umbrella:

| Persona Profile | "The Hustling Freelancer" | "The Agency Project Manager" |

|---|---|---|

| Primary Goal | Maximize billable hours and streamline client communication to take on more projects. | Ensure project timelines are met, manage team capacity, and report progress to stakeholders. |

| Biggest Pain Point | Wasting unpaid time chasing feedback and organizing files from multiple clients. | Juggling multiple complex projects and keeping a distributed team aligned and on task. |

| What They Value | Simplicity, affordability, and a tool that saves them direct, measurable time. | Integration with other tools (like Slack), robust reporting features, and team collaboration capabilities. |

This table makes it obvious why a one-size-fits-all approach would fail. The freelancer wants a simple, cheap tool to solve a personal headache. The agency manager needs a powerful, feature-rich platform to wrangle a team. Nailing down these key differences early is what effective market research is all about.

Picking The Right Tools For The Job

Okay, you've got your objectives nailed down. Now, how do you actually get the answers you're looking for? This is where you pick your market research methods, and for a startup, it's all about being smart and scrappy. You don't need a massive budget, just a clever approach.

The two worlds of research you'll be living in are secondary research and primary research.

Think of it this way: secondary research is using information that someone else has already done the hard work of collecting. It's your starting point. Primary research is the new information you gather yourself, straight from the source. The trick isn't to pick one over the other—it's to use both, in the right order.

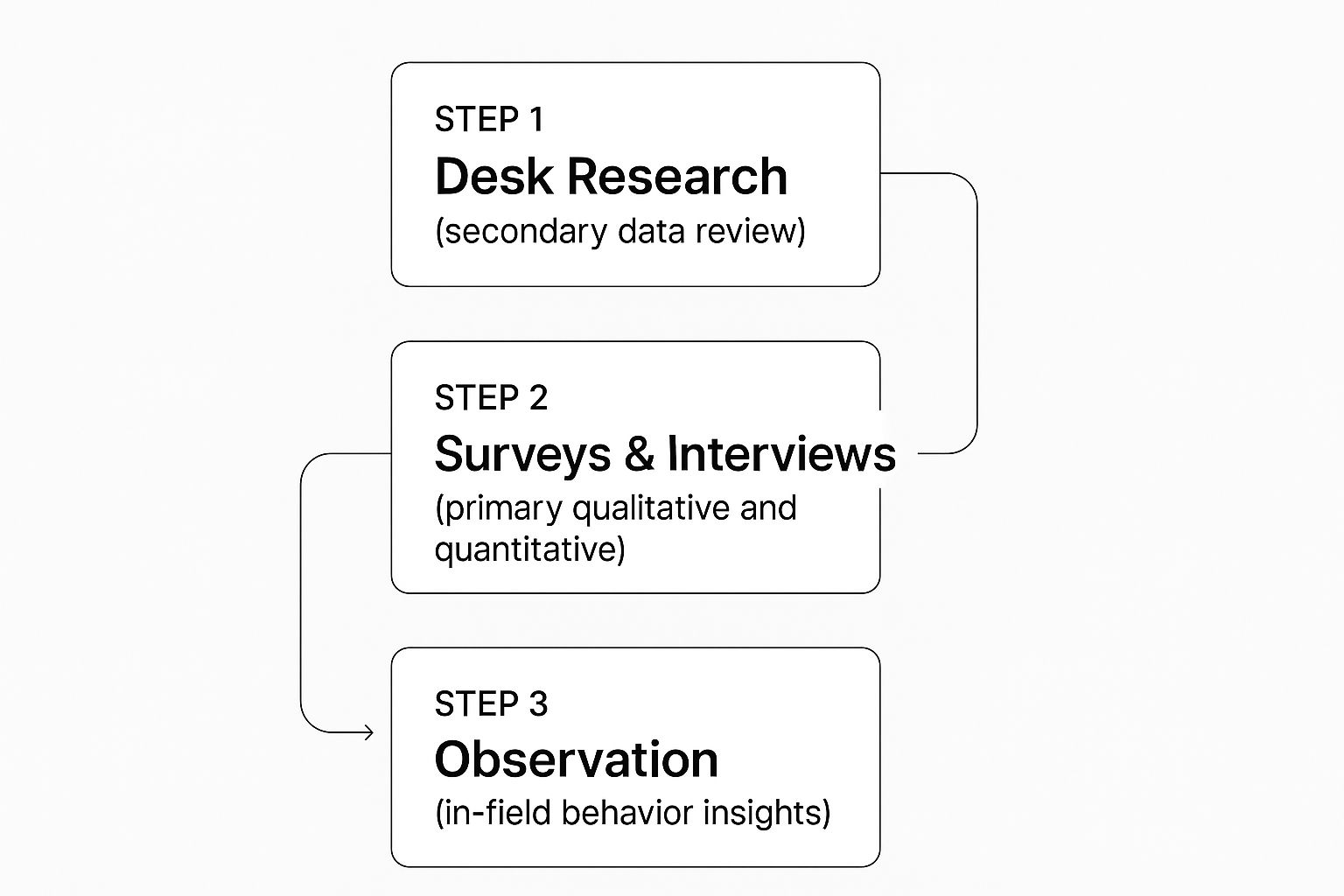

This flow gives you a good visual of how to stack your research, starting broad and then zooming in on what matters most to your specific idea.

You always want to start with what’s already out there before you spend a single dollar or minute creating your own data from scratch.

Start With What's Already Out There: Secondary Research

When you have more time than money—which is the classic startup reality—secondary research is your secret weapon. This is your "desk research" phase. You're basically a detective, pulling together clues about your market from information that's already public. It's the fastest and cheapest way to get a lay of the land.

Here’s where you should be digging:

- Industry Reports: Big-name firms like Gartner or Deloitte publish reports that give you a 30,000-foot view of market size, growth, and major trends.

- Competitor Analysis: Go deep on your competitors. Tear down their websites, analyze their pricing, and scour customer reviews on platforms like G2 or Capterra. What do their customers love? What do they hate? That's where your opportunity lies.

- Public Data: Don't overlook free government resources. The U.S. Census Bureau, for example, has a goldmine of demographic data you can use to understand who your customers are and where they live.

This initial digging should help you answer the big-picture questions and, just as importantly, show you what you don't know. Those gaps are exactly what you'll investigate next.

Think of secondary research as studying the map before you start your journey. It won't tell you everything about the terrain, but it will show you the main roads, mountains, and rivers so you don't start walking in the wrong direction.

Get Answers Straight From The Source: Primary Research

Once you have a solid feel for the market, it's time to talk to actual people. Primary research is where you go directly to your target audience to gather your own, custom data. This is how you confirm or—more often—challenge the assumptions you made during your secondary research.

For most startups, this boils down to two key methods: interviews and surveys.

Choosing between primary and secondary methods (and the specific tactics within each) depends on what you need to learn. Here’s a quick breakdown to help you decide where to focus your energy.

Primary vs Secondary Research Methods for Startups

| Research Method | Best For | Pros | Cons |

|---|---|---|---|

| Interviews (Primary) | Understanding the "why" behind customer problems and behaviors. | Rich, qualitative insights. High flexibility to dig deeper. | Time-consuming. Small sample size, so not statistically significant. |

| Surveys (Primary) | Validating assumptions with a larger group and gathering quantitative data. | Scalable. Can generate statistically useful data quickly. Easy to analyze. | Lacks context. Poorly worded questions can lead to misleading results. |

| Industry Reports (Secondary) | Getting a high-level view of market size, trends, and major players. | Saves time. Provides a solid foundation and credibility. | Often expensive. Can be too broad or slightly outdated for a niche startup. |

| Competitor Analysis (Secondary) | Identifying gaps in the market and understanding customer pain points. | Fast and cheap. Provides a clear picture of the competitive landscape. | You only see what they want you to see. Doesn't reveal their strategy. |

Ultimately, you need a mix. Start with the free, readily available secondary data to build your foundation, then use targeted primary research like interviews and surveys to fill in the gaps and get specific feedback on your idea.

Customer Interviews

Interviews are all about gathering qualitative insights. These are conversations, not interrogations. Your goal is to uncover the stories and emotions behind a customer's problem.

For example, don't ask, "Would you use an app that helps you manage your budget?" Instead, try: "Tell me about the last time you felt stressed about your finances. What was that like?" This open-ended style gets you the rich, nuanced feedback you can't get from a checkbox. Aim to conduct 5-10 insightful interviews for each of your key customer segments.

Surveys

Surveys are your tool for quantitative data. They are perfect for collecting measurable information from a larger group to spot patterns and validate what you learned in your interviews.

A good survey can help you test demand for certain features or get a feel for what people might be willing to pay. With simple tools like Google Forms or Typeform, you can easily survey 50-100 people. While not perfectly scientific, this gives you enough data to see which direction the wind is blowing.

Tapping Into Modern Tools for Smarter Research

Deep market research used to be a game only big corporations could afford to play. Not anymore. Today, a whole arsenal of modern tools lets scrappy startups gather powerful insights quickly and, in many cases, for free. This turns what felt like an impossible mountain into a climb you can actually make.

The trick is knowing which tool to grab for the right job. You don't need a thousand-dollar-a-month software suite right out of the gate. A smart mix of free and affordable platforms can give you all the answers you need to see if your idea has legs and figure out who your first customers are.

Going Straight to the Source: Direct Customer Feedback

The fastest way to test an assumption? Just ask your potential customers. This is where survey platforms are your best friend for gathering hard numbers at scale.

- Google Forms: This is your ground zero. It’s 100% free, dead simple to use, and automatically dumps all your responses into a Google Sheet. It's perfect for quickly gauging interest in features or getting a feel for pricing.

- Typeform: When you want a survey that doesn’t feel like a survey, Typeform is fantastic. Its conversational style makes it more engaging, which usually means more people will actually finish it. The free plan is surprisingly robust for most early research.

For instance, you could whip up a quick Typeform survey asking your target audience to rank their top three frustrations with their current workflow. Suddenly, you have clear data telling you exactly where to focus your product development.

A great survey isn't just a list of questions. Think of it as a guided conversation. Keep it short, to the point, and make sure it works well on a phone to show people you respect their time.

Listening In on Real Conversations

Your target audience is already talking online; your job is to find out where and listen in. Social listening and digging through online communities are brilliant, scrappy ways to get unfiltered insights without asking a single leading question.

Just think about forums like Reddit or niche Facebook groups. I've found gold by searching subreddits like r/freelance for phrases like "I'm so frustrated with…" or "I wish there was a tool for…". You'll find raw, honest pain points that are invaluable for a new startup. Tools like BuzzSumo can also show you what articles are getting shared in your industry and what questions people are asking about your competitors. This is how you move from a vague gut feeling to a decision backed by real evidence.

Watching What People Do and Sizing Up the Market

Once you have something for people to look at—even just a simple landing page—analytics tools become essential for seeing how they actually behave.

- Google Analytics: This is non-negotiable. Get it set up from day one. It tells you who's visiting your site, how they got there, and what they do next. Seeing a ton of people abandon your pricing page? That's a loud-and-clear signal that your value proposition isn't hitting the mark.

- Industry Databases: To get the bigger picture, you need reliable market data. If you’re trying to understand the competitive landscape and need details on other companies, digging into well-organized company information databases can give you a serious edge.

By blending these different tools, you build a powerful research engine. You can float a hypothesis with a survey, go find real-world validation in online communities, and then measure actual behavior with analytics to close the loop. This is the modern way to do market research—it's faster, cheaper, and frankly, a lot more effective.

Turning Your Research Into a Roadmap

You've done the legwork. You’ve got a pile of survey responses, interview transcripts, and market reports sitting in front of you. This is where the real magic happens. Raw data is just noise until you find the story it’s telling you.

Start by sifting through your qualitative data—all those interview notes and open-ended answers. Your job is to spot the recurring themes. Don't just tally up how many times a word was mentioned; listen for the emotion behind the words. When you hear five different people describe the same frustration, you’ve hit a nerve. That’s a real pain point.

Next, turn to your quantitative data. It’s easy to get lost in a sea of charts and percentages. My advice? Stay focused. Zero in on the numbers that directly address the questions you set out to answer in the first place. Slice the data by your customer segments. Do freelancers have different priorities than small business owners? The differences are often where the biggest opportunities hide.

From Numbers to "Aha!" Moments

Once you've pulled out the key patterns, it's time to connect the dots. You need to translate what you found into what it actually means for your business. This is the crucial step of turning a simple data point into a powerful insight.

Let's say you found that 75% of freelancers in your survey cited "unpredictable income" as their biggest headache. That's a data point. The insight? Your new fintech app shouldn't just be another expense tracker—it needs a killer cash flow forecasting feature, and you should lead with that in all your marketing.

An insight isn't just an observation; it's a discovery that fundamentally changes how you view the problem. It’s that "aha!" moment connecting a customer's real-world struggle to a feature, a marketing message, or even your entire business model.

It also helps to zoom out and see where you fit in the bigger picture. The Global Startup Ecosystem Report (GSER) 2025 from Startup Genome, for example, analyzed data from 5 million startups across 350+ ecosystems. Understanding macro trends in hubs like London or New York City can give you valuable context and help you benchmark your own strategy against what’s working elsewhere.

Nailing Down Your Action Plan

The final step is to boil everything down into a simple, clear summary. Forget about writing a 50-page report nobody will read. You need a tight, focused document that your whole team can rally around.

Your summary should cover four key areas:

- Key Findings: What are the three to five most important things you learned?

- Actionable Recommendations: For each finding, what are the exact next steps? Be specific.

- Validated Assumptions: Which of your initial beliefs did the research prove right?

- Invalidated Assumptions: Which of your big ideas turned out to be wrong? (This is just as important!)

This document is now your north star. It’s what you’ll pull out in meetings to justify your product roadmap, inform your marketing copy, and guide your decisions as you build a business that people actually want and need.

Got Questions About Startup Market Research? We've Got Answers.

Jumping into market research can feel like a huge task, especially when you're already juggling a million things to get your startup moving. Let's clear up some of the most common questions founders have so you can get started with confidence.

How Much Money Do I Really Need to Budget for This?

Honestly? Probably a lot less than you think. For a startup just finding its feet, your biggest investment isn't cash—it's your time.

You can kick things off with zero budget by digging into free secondary research. This means getting cozy with public data from places like the Census Bureau, poring over industry reports you can find online, and doing a deep-dive into what your competitors are up to.

When you're ready to talk to actual people (primary research), your first interviews can come from your own network. For surveys, free tools like Google Forms get the job done, and platforms like Typeform have generous free plans. A few hundred dollars might cover some coffee gift cards to thank people for their time or a month of a specialized tool, but you can uncover game-changing insights with next to no money down.

What’s the Difference Between Market Research and Competitor Analysis?

It's a great question. Think of it like this: competitor analysis is a single, crucial chapter in the much larger story of your market research.

- Market Research is the whole book. It’s the entire process of getting your head around the market—customer needs, industry trends, how big the opportunity is, and where the real problems are.

- Competitor Analysis is one specific part of that. It's where you put your rivals under the microscope to see who they are, what they’re good at, where they're dropping the ball, how they price their stuff, and what their marketing looks like.

You're doing competitor analysis as a piece of your overall market research. The goal is to find that gap in the market where your startup can shine.

Where Do I Find People to Interview?

Finding the right people to talk to is more art than science, but it's totally doable. Your immediate network is the easiest place to start, but just be mindful that friends and family might not give you the brutally honest feedback you need.

To find fresh perspectives, LinkedIn is your best friend. Search for people whose job titles match your ideal customer and send a genuine, non-spammy connection request. Also, go where your audience hangs out online—think niche subreddits, private Slack channels, or industry-specific Facebook groups. The key here is to be a real member of the community first. Participate, add value, then ask for a bit of their time. A small gesture, like a coffee gift card or a sneak peek at what you're building, goes a long way.

Here's a pro-tip: Don't just ask for an "interview." Ask for their expertise. People love to share their opinions and frustrations when they feel like they’re helping you solve a real problem.

How Many People Do I Need to Survey to Get Good Data?

The magic number really depends on what you’re trying to learn.

If you're doing qualitative interviews to uncover deep insights, you'll be amazed at how quickly patterns emerge. Speaking with just 5-10 people in a specific customer group can often surface 80% of the most common problems and themes.

For quantitative surveys, the numbers game changes a bit. If you needed to be statistically certain your results reflected a huge population, you'd need hundreds of responses. But for an early-stage startup, your goal isn't academic perfection; it's about finding a clear direction. Even 30-50 well-thought-out survey responses can give you powerful signals to guide your next move.