Running a small business is all about being smart with your resources. Market research is how you do that. It's simply the process of asking the right questions to figure out who your customers are and what they really want before you pour your heart, soul, and money into a project. This isn't about guesswork; it's about validating your ideas to avoid costly mistakes down the road.

Why Market Research Is Your Smartest Investment

Let's be real—when you're running a small business, every dollar and every minute counts. So, why would you spend any of that precious capital on market research? Think of it less as an expense and more as an insurance policy. It's the groundwork you lay to make sure you're building something people will actually line up to buy.

The term "research" might conjure images of expensive consulting firms and reports so dense you could use them as a doorstop. But for a small business, it's about being resourceful and practical. It's about finding clear, simple answers to the burning questions you're already asking yourself.

Answering Your Most Critical Questions

Good research cuts through your own biases and assumptions, giving you a dose of reality. It’s the difference between hoping people will like your idea and knowing they will. It helps you nail down the answers to a few make-or-break questions:

- Will people actually pay for this? This is the big one. Validating demand before you build or buy inventory is everything.

- How do I stand out from the competition? Digging into what your competitors don't do well is where you find your unique edge.

- What language do my customers use? Knowing the exact words your customers use to describe their problems is pure marketing gold.

Finding these answers doesn't require a Ph.D. in statistics. It just requires listening.

The landscape out there is tough. There are a staggering 34.8 million small businesses in the U.S. alone, which accounts for 99.9% of all companies. Owners are constantly battling challenges like inflation (a top concern for 24%) and finding quality labor (21%). With so much pressure on your bottom line, your research needs to give you a sharp understanding of what customers are willing to spend money on right now. You can check out more small business statistics to see just how research can help you navigate these hurdles.

The point of market research isn't to create some massive, flawless report. It's to find just enough information to make your next decision a little bit smarter. It's about reducing uncertainty, not getting rid of it completely.

At the end of the day, doing your homework gives you the confidence to take the next step. Whether you're dreaming of opening a neighborhood coffee shop, launching a new software app, or selling handmade jewelry online, understanding your market is the first real step toward building a business that can go the distance.

Defining Your Research Goals and Key Questions

Before you even think about creating a survey or talking to a customer, you need to know exactly what you're trying to figure out. Jumping into market research without a clear objective is like setting off on a road trip with no map and no destination. You'll just waste time and money, and you'll end up completely lost.

A vague goal like "I want to understand my customers better" is a classic mistake. It's too broad to give you any real, usable information. The secret to effective research is asking sharp, specific questions that lead to answers you can actually act on.

From Vague Ideas to Specific Questions

Let's make this practical. Imagine you own a local coffee shop and you want more morning customers. That's the vague idea. A much more powerful approach is to turn that into a focused research question.

- "What specific breakfast specials or loyalty perks would convince local commuters to choose our cafe over the big chain down the street?"

See the difference? The answer to that question gives you direct clues for changing your menu, creating a new promotion, or tweaking your marketing.

Here's another example for an e-commerce brand with a high cart abandonment rate:

- "What is the single biggest friction point that causes shoppers to abandon their carts during our checkout process?"

Answering that question points you directly to a website fix that can boost revenue almost overnight. Focused questions like these cut through the noise and get you straight to the insights that matter.

Pinpointing Your Ideal Customer

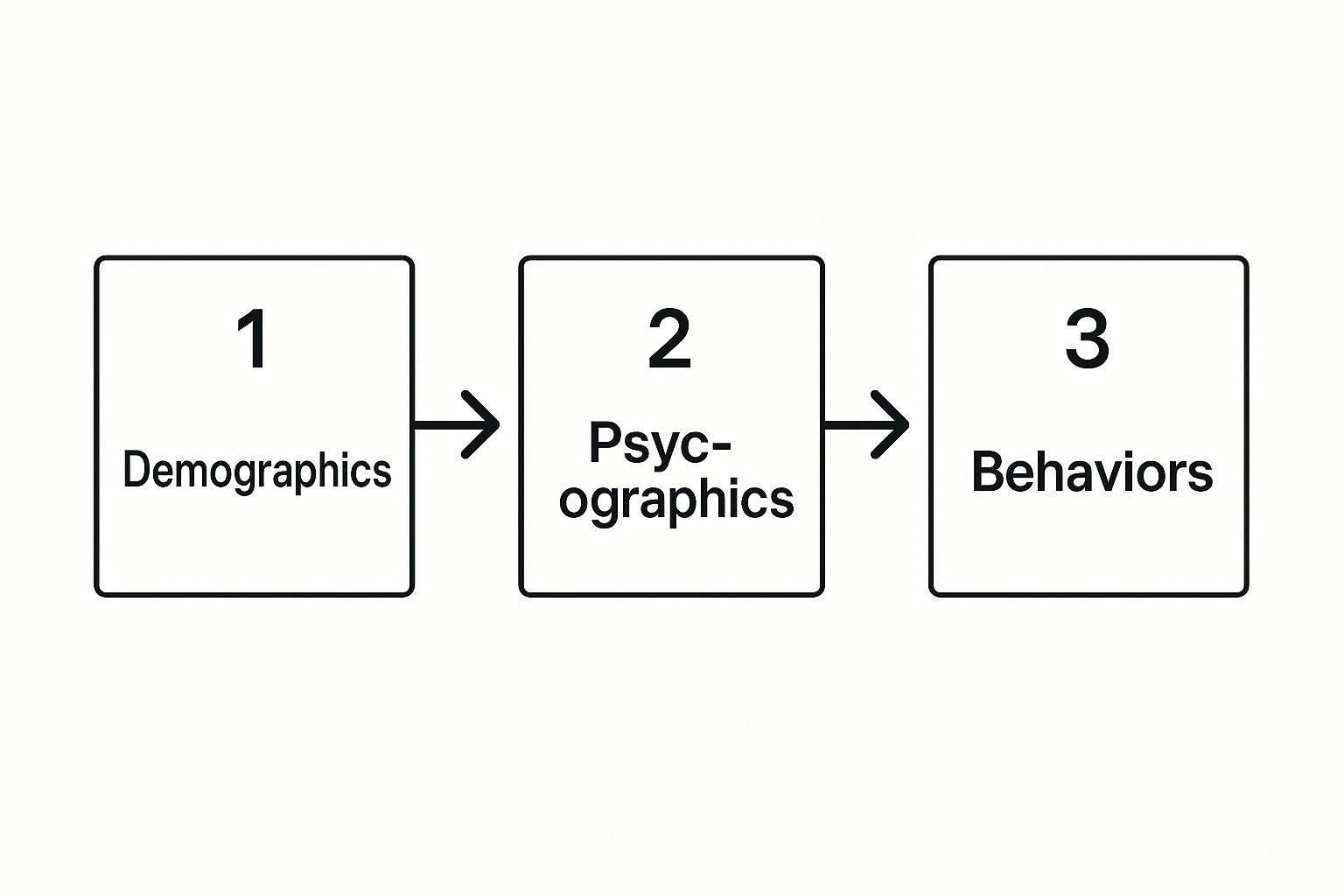

To ask the right questions, you first have to know who you're asking. You can't possibly understand your market until you've defined the people within it. This means moving from general characteristics to their specific habits and motivations.

Think of it as building a complete picture of your customer, layer by layer.

This progression is everything. Demographics give you the basic sketch, psychographics add personality and what drives them, and their behaviors show you how they actually interact with products like yours. Once you understand all three, you can create a detailed profile of your ideal customer, which is essential for asking them the right questions. To really nail this, check out this guide on how to create buyer personas.

Pro-Tip: Try to boil your main research goal down to a single, clear sentence. If you can't explain what you need to learn in one go, it’s probably too complicated. Simplify it until it’s crystal clear.

Why Asking the Right Questions Matters

Setting clear goals isn't just about being organized; it's a fundamental step in protecting your business. According to recent studies, a staggering 35% of small businesses fail because there's simply no market need for what they're selling. Another 38% fail because they run out of cash.

Good research, driven by the right questions, can help prevent both of these disasters. It forces you to get honest answers about product demand, pricing, and your competition before you sink a ton of money into a bad idea.

Ultimately, your key research questions should be laser-focused on solving a real business problem. Here are a few more examples to get you thinking:

- For a new service business: "What are the top three frustrations potential clients have with the current providers in this industry?"

- For a local retail store: "Which marketing channels do our target customers actually trust when deciding to buy products like ours?"

- For a B2B software company: "What specific features would make our ideal customers switch from their current solution to ours?"

When you start with well-defined goals and sharp questions, market research stops being a chore and becomes your most powerful tool for smart, sustainable growth.

Gathering Data Without Breaking the Bank

One of the biggest myths I hear about market research is that it’s expensive. That you need a massive budget and a whole team of analysts to get it right. For a small business, that couldn't be further from the truth.

Good research isn't about how much you spend; it's about being resourceful, creative, and genuinely willing to listen. Let's walk through some practical, low-cost ways to get direct feedback (primary research) and dig up valuable existing info (secondary research), often using tools you already have.

Tapping into Direct Customer Feedback

Primary research simply means you're gathering brand-new data straight from the source—your audience. It’s the best way to get inside their heads. And no, it doesn't have to cost a fortune.

A great place to start is with simple online surveys. Tools like Google Forms or Typeform let you create and send out professional-looking surveys for free or very cheap. Just drop a link in your email newsletter, post it on social media, or add a pop-up to your website.

The key is to keep them short and sweet. Aim for 5-10 questions that get right to the heart of what you need to know. For example, a local bakery could ask, "Which of these new bread flavors would you be most excited to try?" That’s immediate, actionable feedback.

Don't underestimate the power of just talking to people. These don't have to be formal, sit-down interviews. Casual chats while a customer is in your shop or after a service call can give you incredibly honest insights. Ask open-ended questions like, "What made you choose us today?" or "Is there anything we could do to make your experience even better?"

Organizing a Mini Focus Group

If you want something a bit more structured, try a "mini focus group." It sounds formal, but it’s really not. Just invite 3-5 of your most loyal customers for coffee and a chat. Offer a small thank-you, like a gift card or a discount, for their time.

Your role here is to guide the conversation, not just fire off questions. You could show them a prototype of a new product or a mockup of a new website design. Pay attention to how they react, the words they use, and the ideas they bounce off each other. This kind of qualitative feedback is pure gold.

A single, insightful conversation with a real customer is often more valuable than a hundred survey responses. It provides the "why" behind the data, giving you context that numbers alone can't offer.

Remember, economic pressures change what customers value. A recent survey found that a staggering 65% of small businesses had to increase their prices due to inflation. This makes it crucial to keep checking in with your customers about price sensitivity. You can learn more about these trends in the 2025 Service Small Business Insights Survey Report.

Leveraging Existing Information for Free

Secondary research is the art of finding and using information someone else has already put together. This is where you can save a ton of time and money. The internet is a treasure trove of free, high-quality data if you know where to look.

Government resources are an excellent starting point. The U.S. Census Bureau has an incredible depth of demographic data. You can find stats on age, income, and family size right down to your specific city or neighborhood. It's an essential tool for understanding who actually lives in your local market.

Social media is another goldmine. But don't just use it to post—use it to listen.

- Search for keywords related to your services on platforms like X (formerly Twitter), Reddit, or in niche Facebook groups.

- Keep an eye on mentions of your competitors. You'll see what their customers love and, more importantly, what they complain about.

- Look for common questions or frustrations that people in your target audience are talking about. This is "social listening," and it gives you a real-time pulse on what the market wants.

Analyzing Your Competitors

No market research is complete without a good, hard look at your competition. The goal isn't to copy them; it's to understand their playbook so you can find your own unique advantage.

First, identify your top 3-5 direct competitors. Then, put on your detective hat and start digging.

- Check out their website and social media. What's their core message? Who are they talking to?

- Analyze their pricing and what they offer. Are they the budget option or the premium choice? Are there obvious gaps in their services that you could fill?

- Read their customer reviews. Sites like Google, Yelp, and other industry-specific platforms will show you their biggest strengths and most common weaknesses.

- Subscribe to their email newsletter. This gives you a front-row seat to their marketing tactics, sales funnels, and how they communicate with customers.

For a deeper dive, using specialized tools can be a game-changer. Exploring various company information databases can give you structured data on competitors, helping you build a more complete picture of the competitive landscape.

By combining these simple, low-cost methods, you can gather a wealth of information to help you make smarter, more confident decisions—all without a big budget.

Turning Raw Data Into Actionable Insights

Collecting a mountain of survey responses, interview notes, and competitor data feels great, but the real work is just beginning. Raw information is just noise. The magic happens when you start sifting through it, finding the patterns, and turning that chaos into a clear, actionable plan.

This isn't about becoming a data scientist overnight. It's about being a detective, looking for clues that tell you what your customers really think. The goal isn't a hundred-page report; it's finding that one golden nugget of insight that sparks your next smart business move.

Finding the Themes in Your Feedback

Your first job is to dive into the qualitative data—the actual words people used in interviews, open-ended survey questions, and focus groups. You're looking for the same ideas, frustrations, and wishes to pop up over and over again.

Let's say you run a small subscription box service and just finished talking to ten customers. As you go over your notes, a few things jump out:

- Four out of ten people mentioned they wish the packaging was more eco-friendly.

- Six of them absolutely loved the surprise element, but two found it "hit or miss."

- Three people specifically remembered finding you through an Instagram influencer.

These aren't just one-off comments; they're the beginnings of a pattern. When you start grouping these similar ideas together, you transform a bunch of individual opinions into the collective voice of your customer base. It points you exactly where you need to focus.

Sketching Out Simple Customer Personas

Once you have those themes, you can start sketching out some simple but incredibly useful customer personas. A persona is just a fictional character you create to represent a major segment of your audience, using the real data you just uncovered. It helps you stop selling to a faceless crowd and start talking to a person.

Based on your research, maybe two distinct customers emerge for your subscription box:

- "Eco-Conscious Emily": She's 28, sustainability is a huge deal for her, and she'll happily pay more for brands that share her values. She loves the convenience but cringes at the plastic wrap.

- "Gift-Giver Gary": He's 45 and buys the box for his wife's birthday every year. His top priority is making sure the items feel special and high-end. He couldn’t care less about the packaging, but he’s very sensitive to the perceived value of what’s inside.

These quick sketches immediately show you that a one-size-fits-all message won't cut it. Emily needs to hear about your new recycled packaging, while Gary needs to see ads that scream "luxury" and "curation."

Don't go overboard here. For a small business, one or two well-defined personas built on real research are far more powerful than five vague ones. The point is clarity, not complexity.

Running a SWOT Analysis on Your Findings

With your themes and personas giving you a clear picture of your customers, a SWOT analysis is the perfect tool for turning everything into a strategy. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats, and it’s a straightforward way to map out where you stand.

Your market research findings plug directly into this framework:

- Strengths (Internal, Positive): What did customers love? Example: "Our unique product curation is a huge hit."

- Weaknesses (Internal, Negative): What were the most common complaints? Example: "Our website's checkout process is confusing and costing us sales."

- Opportunities (External, Positive): What gaps in the market did you spot? Example: "There's a real demand for sustainable products that our competitors are completely ignoring."

- Threats (External, Negative): Who is your competition and what are they doing right? Example: "A new, cheaper competitor just launched a massive social media campaign."

Laying it all out like this makes the next steps obvious. If a major Weakness is your clunky checkout and a looming Threat is a competitor with a super-slick website, fixing your user experience just shot to the top of your to-do list.

This process—from theme-spotting to the final SWOT—is how you connect the dots between information and intelligent action. To really nail down the "Threats" quadrant, you might want to do a full competitor landscape analysis for a deeper dive. It’s what ensures all your hard work in market research actually leads to real, measurable growth for your business.

Putting Your Research Into Action for Growth

All the data in the world means nothing if it just sits in a folder on your computer. Let's be honest, insights are only valuable when you actually use them. This is the moment where all that hard work gathering and analyzing information finally pays off and translates into real, tangible business growth.

This last part of the process is all about implementation. It's about taking what you’ve learned and using it to make smarter decisions in every corner of your company, from the words you use on your website to the next product you develop.

Translating Insights Into Strategic Moves

Think of your research findings as a roadmap. They point out the potholes to avoid and show you the shortcuts to success. The real trick is to connect each insight to a specific, actionable part of your business.

I once worked with a freelance graphic designer who discovered something interesting through her competitor research: most rivals offered confusing, à la carte pricing. Her insight was that potential clients felt overwhelmed and weren't sure what the final bill would be.

So what did she do? She created three clear, tiered service packages—"Startup Essentials," "Business Growth," and "Total Rebrand"—all with fixed prices. This simple change, driven directly by research, made her offerings instantly more appealing and a whole lot easier for clients to buy.

Your research isn't just a report card on your business; it's a playbook for your next move. Every key finding should lead to the question: "So, what are we going to do about this?"

Refining Your Marketing and Messaging

One of the quickest wins you can get from market research is sharpening your marketing message. When you know the exact words and phrases your customers use to describe their problems, you can speak their language. It's a game-changer.

- Website Copy: Did your research reveal that customers care most about "durability" and not "premium materials"? It's time to rework your product descriptions to highlight how long your stuff actually lasts.

- Social Media Content: If you learned your target audience hangs out on Instagram and loves video tutorials, stop pouring effort into text-heavy Facebook posts. Shift your strategy to where your people are.

- Ad Campaigns: Use those customer personas you built to create laser-focused ads. "Eco-Conscious Emily" should see ads about your sustainable practices, not your rock-bottom prices.

Aligning your message like this means your marketing budget isn't wasted shouting into the void. Instead, you're having a direct conversation with the people who are most likely to become your customers.

Improving Your Products and Services

Sometimes, the most valuable insights force you to look inward and make tough changes to what you sell. This is where research sparks real innovation.

Take an online shop that noticed a ton of people were abandoning their shopping carts. Through a few simple customer surveys, they found the culprit wasn't their products but their checkout process—it demanded too many steps and just didn't feel secure.

Armed with this direct feedback, they simplified the whole thing down to a single page and added trust badges like security logos. The result? A huge drop in abandoned carts and a direct lift in sales. It’s a perfect example of what happens when you listen to your market and act on what you hear.

Making Research an Ongoing Conversation

Finally, it’s critical to remember that market research isn't a one-and-done project you can just check off a list. Markets change, new competitors pop up, and customer needs shift over time. The most successful small businesses I know treat research as a continuous conversation.

You don't need a massive budget for this. Just set a simple schedule to stay in touch:

- Quarterly Check-In: Once a quarter, take a quick peek at your top competitors' websites and social media. What's new?

- Biannual Survey: Send a short feedback survey to your email list twice a year. Keep it simple.

- Ongoing Listening: Spend just 30 minutes each week monitoring social media conversations about your industry.

By building these habits, you create a feedback loop that keeps your business agile and ahead of the curve. You'll spot new opportunities before everyone else does and fix small problems before they become big ones, ensuring your growth is both smart and sustainable.

Answering Your Lingering Market Research Questions

Even with a solid plan, it's totally normal to have a few questions rattling around in your head before you jump in. Let's tackle some of the most common ones I hear from small business owners. Think of this as a quick, honest chat to clear up any last-minute hesitation.

How Much Time Should I Actually Sink Into This?

This is the big one, isn't it? The true answer is, it depends on the size of the decision you're facing.

You don't need to block off a month to research a new social media campaign. A few solid days spent analyzing what your competitors are doing and sending a quick poll to your email list will probably give you everything you need.

But if you're thinking about something bigger—like launching a completely new service or opening a second location—you'll want to be much more thorough. A good way to think about it is to match your research effort to the business risk. The bigger the potential fallout if you get it wrong, the more time you should spend making sure you get it right.

- Small Stuff (like a new blog topic): A couple of hours is fine. Just do some keyword research and see what's trending.

- Medium Decisions (like changing your pricing): Give it a week or two. This gives you enough time to survey some current customers and really dig into competitor pricing.

- Big Moves (like a new flagship product): Plan for a month, maybe more. You'll want to do in-depth interviews, run larger surveys, and conduct a full market analysis.

What if the Results Aren't What I Want to Hear?

Honestly, this is one of the best things that can happen. It might sting a little, but getting negative feedback is a gift. Finding out your brilliant idea has a fatal flaw before you've sunk a ton of time and money into it is a huge win.

Unfavorable research is your chance to tweak, pivot, or even scrap an idea that was headed for a cliff. It’s the cheapest insurance policy against a major business blunder you’ll ever buy.

If the data tells you there’s no market for your idea, listen to it. Don't push forward out of sheer stubbornness. Use those insights to go back to the drawing board. Maybe you were targeting the wrong people, or perhaps the product is missing one critical feature. The research isn't a "no"; it's a "not like this."

How Many People Do I Really Need to Survey?

You can relax on this one. You don't need thousands of responses to get powerful insights, especially at the beginning. For a small business, a small group of the right people is way more valuable than a huge, random crowd.

When you're just exploring an idea, talking to just 5-10 people who fit your ideal customer profile can uncover about 85% of the most common issues and opinions. You'll know you're on the right track when you start hearing the same feedback over and over. That's your pattern.

For surveys where you want hard numbers, you'll need a bigger sample. But even then, getting 50-100 responses from your target audience can give you a really solid sense of their preferences. It’s more than enough to point you in the right direction. Always remember: quality over quantity.