If you're still just keeping an eye on your direct rivals, you’re playing a dangerous game. That old playbook is a surefire way to get blindsided. A true competitor landscape analysis is about so much more than that; it's a full-on, proactive map of your entire market ecosystem. This isn't just a nice-to-have anymore. It's essential for survival.

Why Old Competitor Tracking Falls Short

Relying on traditional competitor tracking is like driving while only looking in the rearview mirror. Sure, you see who’s right behind you, but you're completely missing the threats merging from side streets and the wide-open opportunities just over the horizon. The market is no longer a simple one-on-one race.

Think about it. A SaaS company with a simple project management tool used to only worry about other project management tools. Today? They're up against everything from massive collaboration suites like Slack to flexible no-code builders like Airtable. That's the new reality—competition pops up from startups, adjacent industries, and sometimes even your own partners.

The Blurring Lines of Competition

The digital economy has essentially erased old industry boundaries. Experts predict that by 2025, winning will demand a much more holistic approach to market intelligence. Traditional analysis, which zeroed in on rivals' pricing and product updates, just doesn't cut it anymore. As highlighted in a strategic overview on Contify.com, companies now face threats from indirect peers, new entrants, and even suppliers.

Adopting this broader perspective helps you shift from simply reacting to what's happening to proactively anticipating what's going to happen. It's about understanding the forces shaping your market, not just the players already in it.

"The big purpose behind a competitor landscape analysis is supporting strategic decision-making. This isn’t just about understanding strengths and weaknesses—it’s about charting our course and ensuring we’re not going to be overtaken by some adjacent threat we didn’t see coming."

To truly grasp this evolution, it helps to see the two approaches side-by-side.

Shifting from Competitor Tracking to Landscape Analysis

| Aspect | Traditional Competitor Tracking | Modern Landscape Analysis |

|---|---|---|

| Focus | Direct, known competitors | Entire market ecosystem, including indirect and potential threats |

| Goal | React to competitor moves (pricing, features) | Proactively identify opportunities and threats |

| Scope | Narrow and tactical | Broad and strategic |

| Outcome | Short-term adjustments | Long-term strategy and innovation |

| Analogy | Looking in the rearview mirror | Using a GPS with live traffic and satellite view |

This shift is what separates the companies that adapt and thrive from those that get left behind.

From Reactive Monitoring to Proactive Strategy

The goal here is to avoid 'analysis paralysis'—that feeling of being swamped by data but starved for actual insight. A well-structured competitor landscape analysis helps you cut through the noise and focus on what really matters.

- Spot Emerging Threats: See those startups or companies in other niches before they become major players in yours.

- Uncover Market Gaps: Find out what customer needs are being ignored by the entire ecosystem, not just your main rivals.

- Sharpen Your Unique Value: Clearly define what makes you different when the very definition of a "competitor" is always in flux.

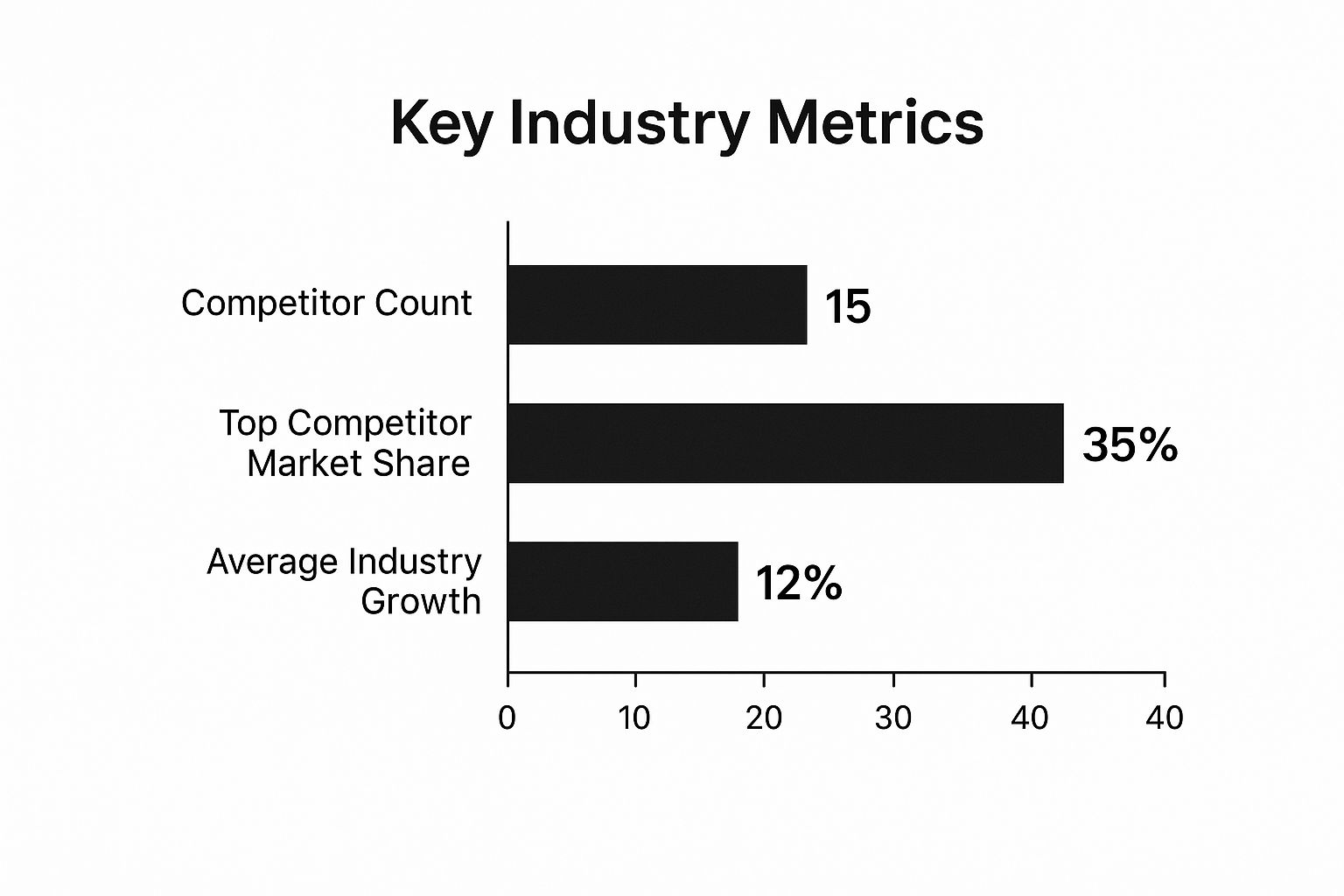

This isn't just theory. Let's look at a visual example of a market breakdown.

The data here paints a clear picture: this is a fragmented market with 15 competitors and a healthy growth rate of 12%. But here's the kicker—the top players only control 35% of the market share. That signals a massive opportunity for disruption and growth. Adopting a modern approach to competitor landscape analysis is your key to capturing it.

How to Figure Out Who You're Really Competing Against

Before you can even begin a proper competitor landscape analysis, you have to answer a surprisingly tricky question: Who are you actually up against?

It’s easy to just list the companies with a product that looks and feels like yours, but that's a surefire way to get blindsided. Your real competition is anyone solving the same core problem for your target customer, even if their solution is completely different.

The goal here is to map out everyone—and everything—vying for your customer’s budget and attention. To do that well, you need to break them down into a few key groups.

Direct Competitors: The Obvious Head-to-Heads

This is the group everyone thinks of first. Your direct competitors offer a similar product to the same audience, tackling the exact same problem you do. If you sell project management software for marketing agencies, other PM tools built for agencies are your direct rivals. Simple enough.

But don’t just make a list and call it a day. The real gold is finding out who you consistently bump into during sales calls. Your CRM is your best friend here. Run a report to see which names pop up most often in deals you’re trying to close. These are the competitors your prospects are actively comparing you against, and they should be your top priority.

Indirect Competitors: The Problem Solvers with a Different Angle

This is where things get interesting. Indirect competitors solve the same fundamental problem, but they do it with a totally different type of solution. They’re the ones who can steal customers right out from under your nose without you ever seeing them coming.

For that project management tool, an indirect competitor could be something as simple as a shared Google Doc or a souped-up spreadsheet in Airtable.

You won't find these names in your CRM's "competitor" field. The best way to unearth them is by digging into your churn data and conducting solid win-loss interviews. When a customer cancels, what are they using instead? When you lose a deal, what was the "other option" the prospect went with?

I can't stress this enough: churn analysis is one of the most powerful tools for finding these adjacent competitors. The people who leave your product know it inside and out. The tool they choose next tells you everything you need to know about your product's limitations and the other ways your audience gets the job done.

Tertiary Competitors: The Budget and Attention Thieves

The last group, tertiary competitors, is the most abstract but no less dangerous. They offer something completely different that competes for the same finite resource: your customer’s time or budget. This isn't always another piece of software.

It could be the decision to hire a freelancer, build a custom solution in-house, or even just stick with the "good enough" manual process they already have.

To spot these, you have to listen closely to what's happening in your market. Keep an eye on conversations happening on Reddit, in niche forums, and on social media. What are people cobbling together to avoid paying for a tool like yours? A great B2B SaaS lead generation strategy can fall flat if it doesn't account for the "build vs. buy" crowd.

A smart way to organize your findings is to map competitors to the specific parts of your product they challenge.

- Market Monitoring: What other tools compete with your data collection features?

- Sales Enablement: Which platforms overlap with how you help teams deliver content?

- Intel Distribution: How else are your customers sharing insights internally besides your tool?

Framing it this way makes you realize you're not just fighting one company. You’re often fighting a collection of specialized, best-in-class tools on multiple fronts. Your analysis suddenly becomes a detailed map of these individual battlegrounds, giving you a much clearer—and more honest—picture of the market.

Gathering Intelligence Without Drowning in Data

So, you’ve mapped out your competitive landscape. Now for the fun part—the detective work. This is where you roll up your sleeves and start gathering the intel that will actually shape your strategy. The goal isn't just to hoard data; it’s about finding those golden nuggets that reveal your competitors' strengths and, more importantly, their weaknesses.

Think of it like piecing together a puzzle. You’re pulling clues from all over the place—hard numbers, customer reviews, your own experience—to build a crystal-clear picture of how they operate, what their customers really think, and where you can outmaneuver them.

Unpacking Their Marketing and Sales Engine

A competitor's marketing is a treasure trove of information. It tells you exactly who they’re targeting, what they think their biggest selling points are, and where they're spending their money to get noticed. Since this is the most public-facing part of their business, it's the perfect place to start digging.

First, take a hard look at their digital footprint. Where are they spending their time and effort? Are they all-in on SEO and content, or are they dominating the conversation on LinkedIn?

- SEO and Content: Use a tool like Semrush or Ahrefs to see what keywords they rank for. This is a direct look into the problems and customer segments they're chasing after.

- Paid Ads: Are they running Google Ads or paid social campaigns? Look at the ad copy. It’s a real-time snapshot of the core message they're pushing right now.

- Social Media: Go beyond just counting followers. What’s their engagement like? What kind of content actually gets a reaction? This can tell you a lot about their community and brand perception.

One of the quickest ways to get a feel for their overall strategy is to look at their traffic sources.

This high-level overview from Semrush, for example, breaks down where a site's visitors are coming from.

A chart like this tells a story. The heavy lean on organic search suggests they've invested heavily in a long-term content and SEO play. On the flip side, very little paid traffic could mean they’re confident in their organic reach, or it could signal a tight budget. Either way, that's a valuable piece of the puzzle.

Go Through Their Product and User Journey

Reading a feature list is one thing. Actually using the product is a whole different ballgame. I highly recommend doing a "ghost signup"—go through their entire customer onboarding process yourself. Sign up for a free trial, use a burner email, and become a new user.

Document everything. Screenshot the welcome emails, the in-app tutorials, and the little pop-ups that guide you. This hands-on research is the only way to truly understand their user experience (UX) and spot the frustrating moments you can capitalize on.

Don’t just click around aimlessly. Pick a real task you’d want to accomplish with their tool and try to do it. If you get stuck or confused, you've just found a major weakness. Your product can win by making that exact same task ridiculously simple.

This approach uncovers the tiny details that separate a clunky product from an elegant one. It also gives you an insider's view of their product positioning. Are they building a simple tool for beginners or a complex powerhouse for experts? The user journey always tells the real story.

For more advanced methods, our guide on competitive intelligence gathering techniques offers some next-level strategies.

Listen to What Their Customers are Saying

Your competitors' customers are the ultimate source of truth. They have no reason to sugarcoat things. Their public feedback on review sites and social media offers unfiltered insight into what the product does well and—more importantly—where it drops the ball.

Make it a regular habit to check sites like G2, Capterra, and industry-specific Reddit threads.

Here’s what you’re looking for in their feedback:

- Recurring Complaints: Are people constantly complaining about the same bug, a missing feature, or a confusing workflow? Those are your opportunities, gift-wrapped.

- Rave Reviews for Specific Features: What do their happiest customers love the most? This helps you understand their core strengths and what their loyal users value.

- Pricing and Value: Do customers feel like they're getting a bargain, or are they grumbling about the price? This is critical intel for refining your own pricing strategy.

You can even automate this by setting up alerts in tools like Google Alerts or a social listening platform. This way, you catch real-time feedback as it happens and stay ahead of any shifts in customer sentiment.

To keep this process organized, a simple checklist can be a lifesaver. It ensures you're systematically collecting the same key data points for every competitor you analyze.

Key Intelligence Gathering Checklist

Here’s a practical checklist to guide your data collection for each competitor, ensuring you cover all the essential bases.

| Data Category | Specific Metrics to Collect | Recommended Tools |

|---|---|---|

| Marketing & SEO | Top organic keywords, estimated traffic, ad copy examples, social engagement rates. | Semrush, Ahrefs, Similarweb |

| Product & UX | Onboarding flow screenshots, core feature usability notes, points of friction. | Your own firsthand testing |

| Customer Voice | Common complaints/praises from reviews, pricing perception, feature requests. | G2, Capterra, Reddit, Twitter |

| Pricing & Plans | All pricing tiers, feature gating, free trial/freemium limitations. | Competitor's pricing page |

| Company Info | Recent funding rounds, key hires, number of employees, recent press mentions. | Crunchbase, LinkedIn, Google News |

By following a structured approach like this, you can move beyond random data collection. You'll start building a comprehensive, nuanced view of the competitive landscape—turning raw information into a real strategic advantage.

Using AI for Smarter Competitor Analysis

Let's be honest, manually building a competitor landscape analysis is a slog. It’s slow, often incomplete, and by the time you're done sifting through everything, your insights are probably already stale. This is exactly where AI is completely changing the game.

AI-powered tools do more than just scrape data. They’re built to automate the tedious collection process, spot trends you’d never catch on your own, and even start predicting what your competitors might do next. Their real magic is in how they handle massive amounts of unstructured data.

Think about it: trying to read every customer review, news mention, and social media post about your top ten competitors is a humanly impossible task. An AI, on the other hand, can digest all of that in minutes. It pulls out themes and sentiment that would take a dedicated team months to uncover.

Automating the Heavy Lifting

The most immediate win you get from AI is automation. Instead of someone on your team spending hours every week checking competitor websites, social feeds, and pricing pages, an AI platform does it for you—continuously and in real time.

This frees up your people to do what they do best: think strategically.

These tools can keep an eye out for specific triggers, like:

- Pricing Changes: Get an instant alert the second a competitor tweaks their pricing or rolls out a new discount.

- New Feature Launches: Know right away when a rival pushes a new feature, often by spotting changes in their website code or help docs.

- Shifts in Marketing: AI can analyze a competitor's homepage or ad copy to flag a new value proposition or a pivot to a new audience.

This kind of constant monitoring turns your analysis from a static quarterly report into a living, breathing process.

The adoption of AI-driven tools is transforming market research. Businesses that integrate AI-powered competitor analysis benefit from automated data collection, pattern identification, and real-time intelligence. This shift accelerates insight generation and helps companies stay responsive, as experts note that failing to adopt AI for competitive intelligence creates a significant risk of falling behind. Discover more insights on how AI is reshaping market research on SuperAGI.com.

Uncovering Deeper Insights and Predicting Moves

Monitoring is one thing, but the real power of AI lies in its analytical brain. By churning through enormous datasets, machine learning models can find patterns that are practically invisible to us. This is where your analysis goes from just describing what happened to predicting what will happen next.

For instance, an AI tool could analyze a competitor’s job postings. It might pick up on a sudden spike in hiring for engineers with a very specific skill, like mobile development. That isn't just a random data point; it's a huge signal they're about to make a big push into a new product area.

Similarly, AI-driven sentiment analysis gives you a much clearer view of what customers really think than just skimming a few G2 reviews. It can measure if sentiment is trending up or down over time and pinpoint the exact features or problems causing those shifts.

Here’s what that looks like in the real world:

- An AI platform scans thousands of customer reviews for Competitor X around the clock.

- It detects a 15% increase in negative comments about "customer support" in the last three months.

- At the same time, it flags that Competitor Y just launched a new "24/7 Premium Support" package.

- Your team gets an alert that connects these dots, showing a clear opportunity: Competitor X is dropping the ball on support right as Competitor Y is investing in it. This creates a gap in the market for you to exploit.

That level of insight is almost impossible to achieve manually, especially at scale. AI doesn't just throw data at you; it connects the dots, making your competitor analysis faster, deeper, and a whole lot more strategic.

Turning Your Analysis into a Winning Strategy

Gathering piles of data is one thing. Turning that raw information into a clear, actionable strategy is where you really get your money's worth from a competitor landscape analysis. This is the moment you connect the dots, moving from scattered insights to decisive actions that give your SaaS a genuine edge.

The goal isn't to create a static report that gathers dust. It's to build a living strategic framework that directly informs your product roadmap, marketing campaigns, and even your pricing. Without this crucial step, all your hard work is just an academic exercise.

Create a Competitive Matrix to Visualize the Field

One of the most powerful ways to make sense of everything is with a competitive matrix. This isn't just a fancy chart; it's a visual snapshot of the market that instantly clarifies where everyone stands—including you. It helps you pinpoint your unique position and spot the crowded corners of the market to avoid.

Start by choosing two key axes that truly matter to your customers. Don't settle for generic metrics like "price" and "features." Instead, pick dimensions that reflect the core value propositions in your market.

A project management tool, for example, might use:

- X-Axis: "Ease of Use" (from Simple/Intuitive to Complex/Powerful)

- Y-Axis: "Target User" (from Individual Freelancers to Enterprise Teams)

Once you've got your axes, plot yourself and each competitor on the matrix. Suddenly, the landscape becomes crystal clear. You might discover that three of your biggest rivals are all clustered in the "Complex/Enterprise" quadrant, leaving a wide-open opportunity for a simple, intuitive tool aimed at small teams.

This visualization exercise is often a real eye-opener. It forces you to be brutally honest about where you truly fit in the market, not just where you think you fit. It’s the first step in carving out a defensible and profitable niche.

Perform a SWOT Analysis Fueled by Real Intelligence

With your market visually mapped out, it's time for a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats). But this isn't the vague, high-level SWOT you might have done in a business class. This one is powered by the specific competitive intelligence you've just spent all that time gathering.

Every point in your analysis should be backed by a piece of data you uncovered.

- Strengths: What do your customer reviews consistently praise that competitor reviews complain about? (e.g., "Our onboarding is rated 9/10 on G2, while Competitor X's is a common source of frustration.")

- Weaknesses: Which feature gap consistently comes up in your win-loss interviews? (e.g., "We lose 20% of deals because we lack a native mobile app.")

- Opportunities: What underserved keyword is a competitor ignoring? (e.g., "Competitor Y gets zero traffic for 'agile marketing project management,' creating a clear SEO opportunity.")

- Threats: Is a well-funded startup gaining traction by targeting a niche you serve? (e.g., "Startup Z's user base has grown 50% in the last quarter among freelance designers.")

This data-driven approach transforms SWOT from a simple brainstorming session into a powerful strategic planning tool.

Translate Insights into Actionable Initiatives

Now for the most important part: connecting your analysis directly to business outcomes. This is where you build the bridge from insight to execution, ensuring your research drives tangible results across the company.

Your findings should become direct inputs for your departmental goals.

-

For Product Development: Discovering your top competitor lacks a key integration is no longer just an interesting fact. It becomes a high-priority item on your product roadmap, complete with a business case showing the potential market share you can capture.

-

For Marketing Teams: Identifying a competitor’s poorly optimized landing page for a high-intent keyword isn’t just an observation. It becomes the basis for a new content campaign designed to dominate that specific search term. Many of the most effective B2B SaaS marketing strategies are born directly from this kind of granular competitive insight.

-

For Sales and Pricing: Learning that customers view a rival's pricing as confusing and overly complex is your cue. You can simplify your pricing tiers and arm your sales team with battlecards that explicitly highlight your transparent pricing as a key differentiator.

This process ensures your competitor landscape analysis has a direct and measurable impact on the business. It’s a testament to the growing importance of this function, which is reflected in the market's own growth. The global Competitor Analysis Evaluation market was valued at $4.32 billion in 2021 and is projected to climb past $6.6 billion by 2025, showing just how critical these insights have become. To dig deeper into these trends, you can explore the market report from CognitiveMarketResearch.com.

Common Questions About Competitor Analysis

Even after you've got a solid plan, doing a competitor landscape analysis always seems to bring up a few tricky questions. I've been there. Let's walk through some of the most common ones I hear and get you clear, practical answers to keep you moving forward.

Getting these details right—from how often you check in to who you focus on—is what separates a useful analysis from a document that just gathers dust.

How Often Should I Conduct a Competitor Analysis?

This is probably the number one question people ask. The honest answer? It's not a one-and-done project you can check off a list. The market simply moves too fast for an annual report to have any real value.

Think of it as an ongoing process with different cadences.

I’ve found a hybrid approach works best. Plan for a major deep-dive analysis either quarterly or semi-annually. This is where you can really dig in and spot the big strategic shifts. But for the day-to-day, you need a system for real-time monitoring.

- Quarterly Deep Dives: This is your chance to update the full competitive matrix, refresh your SWOT analyses, and share the big picture with the rest of the team.

- Ongoing Monitoring: Set up alerts. Use tools to keep an eye on things like pricing changes, new feature announcements, or shifts in messaging. This should be a light-touch, weekly or even daily check-in.

This two-pronged strategy gives you the best of both worlds: deep strategic insight without the constant panic of trying to track every little thing, every single day.

What If I Have Too Many Competitors?

It’s easy to feel like you're drowning in data when your list of rivals gets long. If you're trying to track 50+ competitors with the same intensity, you're going to burn out. The trick is to get ruthless with prioritization.

The best way to do this is to sort them into tiers based on how much of a threat they really are.

- Tier 1 (Top 3-5): These are your direct, head-to-head competitors. The ones you lose deals to. You need to know everything about them.

- Tier 2 (Next 5-10): This bucket is for the strong indirect players or the up-and-comers who are starting to make noise. You don't need to track their every move, but you should be watching their major launches and marketing pushes.

- Tier 3 (Everyone Else): Keep this group on a radar, but don't get lost in the weeds. A quick check-in once a quarter is usually enough to make sure no one is sneaking up on you.

This simple tiering system forces you to focus your energy where it actually counts.

The biggest mistake I see teams make is treating every competitor as an equal threat. Your real job is to understand the rivals who are directly impacting your bottom line. Tiering brings that critical focus back to your analysis.

What Are the Ethical Lines in Gathering Intelligence?

This is a big one, and it’s non-negotiable: you have to stay on the right side of the ethical line. We're gathering public intelligence, not engaging in corporate espionage. Your company's reputation is worth far more than any single piece of data.

Here are some simple do's and don'ts to keep you on the straight and narrow:

| Do ✅ | Don't ❌ |

|---|---|

| Sign up for free trials and attend their public webinars. | Lie about who you are or what company you work for to get access. |

| Analyze public data from G2, Capterra, and social media. | Ask a new employee to share confidential information from a former job. |

| Read every press release, blog post, and help doc they publish. | Try to hack or find backdoors into their systems. |

| Talk to your own customers about why they chose you over a rival. | Pay a third party for information that was clearly obtained unethically. |

Here’s a good rule of thumb: act as if your methods were going to be published on the front page of the Wall Street Journal. If something feels sketchy, it probably is. Stick to the wealth of information that’s already publicly available—I promise, there’s more than enough there to build a winning strategy.