Competitive intelligence isn't just some abstract business school concept; it's the systematic, ethical gathering of information about your market and, more importantly, your competitors. For B2B SaaS sales teams, this means taking raw data about your rivals—like a sudden pricing change, a new feature launch, or a string of bad customer reviews—and turning it into a tactical advantage that directly boosts your win rates.

It’s about knowing your competition inside and out so you can serve your customers better than anyone else.

Why Competitive Intelligence Is a Sales Superpower

In today's crowded B2B SaaS world, knowing your own product is just table stakes. Your prospects are constantly evaluating alternatives. By the time they get on a call, your sales reps are already being compared against two or three other vendors.

Without a solid process for gathering competitive intelligence, your team is flying blind. They're walking into a battle of wits unarmed.

This isn’t about fluffy theories; it’s about gaining real-world advantages that close deals. It’s the difference between being on your back foot and leading the charge.

A proactive sales team doesn't just react when a competitor's name comes up. They see it coming. They reframe the conversation and use their knowledge to build an airtight case for their own solution before the prospect even thinks to object.

Moving From Reactive to Proactive Sales Intelligence

The old way of handling competitors was purely reactive. A salesperson would hear a competitor’s name, frantically search for a battle card, and try to defend their product on the spot. This usually ends in one of three ways: panicked discounting, a desperate feature-dump, or losing the deal entirely because they couldn't articulate a clear differentiator.

A modern, proactive approach flips the script. Here’s a look at the shift from the old, reactive way to a more strategic, proactive mindset.

| Characteristic | Reactive Approach (The Old Way) | Proactive Approach (The New Way) |

|---|---|---|

| Trigger | Prospect mentions a competitor. | Ongoing monitoring of the market. |

| Information | Outdated battle cards, hearsay. | Real-time intel, win/loss analysis. |

| Sales Rep Action | Defends product features on the fly. | Guides the conversation, sets traps. |

| Outcome | Price wars, feature comparisons. | Higher win rates, shorter sales cycles. |

| Mindset | "How do we defend against them?" | "How do we position against them?" |

Adopting this proactive stance gives your team the intel they need to get ahead and stay there. It completely changes the dynamic of the sales conversation.

The Impact of a Proactive Strategy

When your team is armed with proactive intelligence, they can:

- Anticipate Objections: You've been tracking a competitor's negative G2 reviews about their poor onboarding. Your rep can now proactively say, "I know a smooth implementation is critical for you, which is why we provide a dedicated onboarding specialist for your first 60 days." The objection is handled before it's even raised.

- Neutralize Competitor Claims: A rival launches a flashy marketing campaign about their "all-in-one" platform. Your team is already equipped with talk tracks that highlight how their "all-in-one" solution is a master of none, while your specialized tool excels at the one thing the prospect truly cares about.

- Position as the Only Real Choice: Understanding a competitor’s weaknesses helps you zero in on the deals you're built to win. This strategic focus is a cornerstone of effective B2B SaaS lead generation. You stop wasting time on bad-fit leads and double down where you have an undeniable advantage.

The Market is Waking Up

This shift from guesswork to a data-driven strategy is exactly why the competitive intelligence (CI) market is exploding. Once valued at USD 50.87 billion, the global CI market is on track to hit a staggering USD 122.77 billion by 2033.

This isn't just a fad. Companies are finally treating CI as a core business function, not a side project for an intern. In fact, many organizations are growing their CI teams by an average of 25% to make sure these critical insights get in front of the executive team.

At the end of the day, a real commitment to competitive intelligence gives your sales team something priceless: confidence. It replaces fear and uncertainty with clarity and control. They stop selling against the competition and start selling through them, making your value so obvious that the choice becomes simple for the customer.

Building Your Sales Intelligence Framework

Great competitive intelligence isn't about aimless Google searches or peeking at a competitor's blog once in a blue moon. It's a system—a machine you build once and then keep feeding. When you put a solid framework in place, your sales team gets the right information exactly when they need it, turning insights into wins without getting buried in data.

The whole thing starts with knowing what you’re actually looking for. Instead of trying to know everything, you need to define your Key Intelligence Topics (KITs). These are the specific, high-impact questions your sales team needs answered to close more deals.

Defining Your Key Intelligence Topics

Think of KITs as the core questions that give your reps an immediate edge in a conversation. They're what separate "interesting facts" from "deal-winning intel." Don't overthink it. Just start with a few critical areas.

For a B2B SaaS team, a few powerful KITs might look like this:

- Pricing and Discounting: What are their list prices? Even better, what kind of discounts do they offer, and when do they pull that lever?

- Product Gaps and Weaknesses: What are customers complaining about over and over again on sites like G2 or Capterra? Where does their user experience consistently fall flat?

- Ideal Customer Profile (ICP): Look at their case studies. What kinds of companies are they showcasing? What industries and company sizes are they targeting with their marketing?

- Sales Objections and Counters: How are they positioning themselves against you? What are their go-to lines when a prospect brings up your product?

The goal isn't to create an encyclopedia on your competitors. It's to find the specific nuggets of information that help your sales team lead more confident, strategic conversations. Focus on what actually moves the needle in a sales cycle.

Once you have your KITs, the next step is figuring out exactly where you're going to get the answers. This is about being deliberate, not just hoping insights fall into your lap.

Mapping Your Intelligence Sources

Your intel will come from two main places: public sources and internal sources. A truly effective framework pulls from both. Public sources show you the story your competitors want to tell, while internal sources give you the ground truth from your own team's battles.

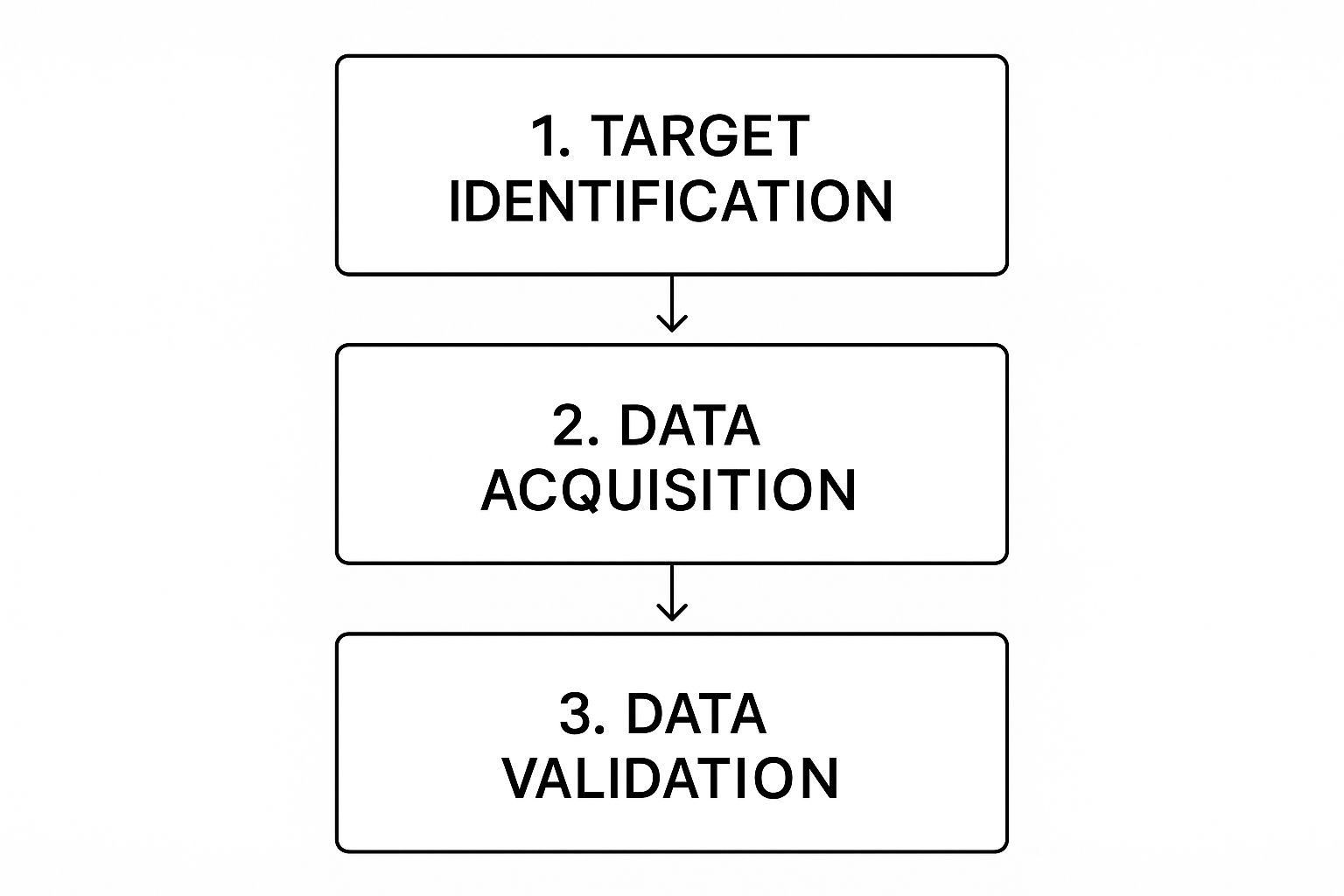

This simple flow shows how it works: identify your targets, grab the data, and then—most importantly—validate it.

This really is the core discipline of competitive intelligence. You target a specific need, acquire the data, and then double-check it before anyone uses it.

Public Sources to Monitor Systematically:

- Review Websites (G2, Capterra): This is an absolute goldmine for finding customer pain points and product gaps. Search for the recurring themes in their 1 and 2-star reviews. That's where the real story is.

- Social Media & Forums: Follow key executives from your competitors on LinkedIn. Keep an eye on relevant subreddits or industry forums where real users are talking about their products.

- Press Releases & News: Set up Google Alerts for your top competitors. This will tip you off to new funding rounds, major partnerships, or big leadership changes.

- Job Postings: A competitor suddenly hiring 15 enterprise reps for the Midwest? That's a huge signal about their expansion plans. If they’re hiring a bunch of engineers for a specific feature, you know what’s coming on their roadmap.

Internal Sources You Already Have:

- Win/Loss Analysis: This is probably your single most valuable source. When you lose a deal, find out exactly why. Was it price? A missing feature? Their relationship? And when you win, ask what the deciding factor was that pushed you over the edge.

- Sales Rep Field Notes: Your reps are on the front lines, hearing this stuff every single day. Make it mandatory—and simple—for them to log competitor mentions and insights right into your CRM after a call.

Creating a Central Intelligence Hub

All this great intel is completely useless if it’s scattered across a dozen Slack channels, siloed spreadsheets, or one rep's personal notes. The information has to be dead simple to find in the middle of a heated sales call.

Your "hub" doesn't need to be some complicated, expensive platform. Start with what works for your team’s existing workflow.

- A Shared Knowledge Base: Tools like Notion, Confluence, or even a well-organized Google Drive are perfect for this. Create a dedicated page for each major competitor.

- A Dedicated CI Platform: For teams that are further along, specialized platforms can automate a lot of the collection and distribution of this intel.

- Right Inside Your CRM: This is often the best option. Build competitor fields directly into your CRM records. This puts the data exactly where your sales team lives and breathes every day.

By defining your KITs, mapping your sources, and centralizing everything you find, you create a repeatable system. This framework takes competitive intelligence from a random, reactive chore and turns it into a strategic weapon that helps your team win, consistently.

Choosing Your Modern Intelligence Gathering Tools

Trying to gather competitive intel manually is a surefire way to fall behind. The right tech stack, on the other hand, flips the script. It turns a reactive chore into a proactive, automated advantage, feeding your sales team the exact intel they need, right when it matters most.

This isn't about collecting every shiny new platform you can find. It's about building a focused toolkit that automates the hunt for your Key Intelligence Topics (KITs). You want to get an alert when a competitor changes their pricing page, tweaks their marketing message, or gets hit with a wave of bad reviews—without your team spending hours digging for it.

This strategic shift to technology is why the competitive intelligence tools market is booming. Valued at around USD 452.36 million, it's projected to skyrocket to nearly USD 1.49 billion by 2034. This growth highlights how much businesses now rely on smart digital tools to get an edge. You can explore more on the competitive intelligence tools market growth to see where the industry is heading.

Your Essential Sales Intelligence Toolkit

The landscape of intelligence tools can feel overwhelming. To simplify, think of them in terms of the specific job you need them to do. Here’s a breakdown of the core categories that deliver the most value for a B2B SaaS sales team.

| Tool Category | Primary Use Case | Example Tools |

|---|---|---|

| Website & Traffic Analysis | Uncovering competitor digital strategy, traffic sources, and top-performing content. | Similarweb, Ahrefs |

| Social & Brand Monitoring | Tracking brand mentions, customer sentiment, and real-time market conversations. | Brand24, Mention |

| Customer Review Aggregators | Finding unfiltered feedback, identifying competitor weaknesses, and spotting churn signals. | G2, Capterra |

| AI-Powered Intelligence | Analyzing diverse datasets to predict competitor moves and surface strategic insights. | Kompyte, Crayon |

Each of these categories provides a different lens through which to view your competition, and together they create a powerful, 360-degree picture of the market. Let's dig into how you can use them.

Website and Traffic Analysis Tools

You have to know where your competitors are finding their customers. It's one of the most fundamental pieces of intel you can gather. Website traffic analyzers give you a direct look into their digital marketing engine.

Tools like Similarweb or Ahrefs are indispensable here. They can reveal a competitor's top traffic sources, the keywords they’re ranking for, and which countries are driving the most traffic.

For a sales rep, this is tactical gold. Let's say you discover a rival is getting 30% of their web traffic from a single industry blog. That’s not just a statistic; it’s a signal. It could spark a new partnership or content strategy for your team, letting you tap into a high-value audience you didn’t even know you were missing.

Social Listening and Brand Monitoring

Every single day, your competitors and their customers are talking online. Social listening platforms are your way of tuning into those conversations to pull out what’s truly important.

With a platform like Brand24 or Mention, you can track mentions of competitor brands, products, and even key executives across social media, forums, and news sites. Setting up real-time alerts for specific keywords is a game-changer.

Think about what this unlocks:

- Spotting Product Flaws: You get an alert when someone tweets, "I'm so frustrated with [Competitor Product]'s integration." This is a perfect opening for your reps to highlight your own seamless connectivity.

- Catching Churn Signals: A user on Reddit asks for alternatives to your competitor's software. Your team can be the first to jump in with helpful advice.

- Gauging Campaign Buzz: You can see the instant sentiment—good or bad—around a competitor’s new feature launch, giving you a real-time read on how the market is reacting.

This isn't about spying. It's about listening to the public conversation. The insights are already out there—the advantage comes from having a system to find and act on them faster than everyone else.

Customer Review Aggregators

Nowhere is the voice of the customer more honest than on review sites like G2 and Capterra. This is where you find the raw, unfiltered truth about your competitors' strengths and, more importantly, their weaknesses.

Manually checking these sites is a waste of time. The real power is in setting up alerts or using tools that scrape and summarize new reviews. You want an immediate notification the moment a new 1-star or 2-star review drops for a key competitor.

This intel feeds directly into your sales plays. If a rival consistently gets trashed in reviews for their poor customer support, your entire team should have talking points ready that emphasize your dedicated support model and stellar response times. You're turning their biggest weakness into your key differentiator.

The Rise of AI-Powered Intelligence

Beyond basic monitoring, a new generation of AI-powered tools is changing the game. These platforms don't just report on what happened; they analyze huge datasets to suggest what might happen next.

For example, an AI tool might analyze a competitor's job postings, recent press releases, and their tech stack to predict a strategic move, like an expansion into a new market. While these platforms often require a bigger investment, they represent the future of competitive intelligence.

Ultimately, the best tools are the ones your team actually uses. You can start small with free options like Google Alerts, then strategically add paid platforms that automate the most painful parts of your intel gathering. The goal is a tech stack that works for you, delivering a steady stream of insights that help your sales team win.

From Raw Intel to Winning Sales Plays

Let's be real: collecting competitor data is only half the job. A shared drive stuffed with screenshots and pricing pages won't close a single deal. The magic happens when you turn that raw information into sharp, actionable sales plays that your reps can actually use on a call.

This is where analysis transforms messy data into ammunition. Every piece of competitive intelligence has to answer the "so what?" question for your team. If an insight doesn't help a rep anticipate an objection, highlight a killer feature, or disqualify a bad-fit lead faster, it’s just noise.

Find Their Achilles' Heel in G2 Reviews

One of the fastest ways to find a competitor's weakness is to read what their unhappy customers are saying. Don't just glance at the star ratings. The real gold is buried in the one, two, and three-star reviews on sites like G2 and Capterra. You're looking for patterns.

Imagine you sell a project management tool, and you’re constantly up against "ProjectFlow." You spend an hour digging into their reviews and notice a few common complaints pop up again and again:

- "The mobile app is incredibly clunky and almost unusable."

- "Great on desktop, but our field team can't get anything done on their phones."

- "Syncing between mobile and desktop is a nightmare. We lost an entire project board."

Bingo. This isn't just random feedback; it's a strategic opening. You’ve found a clear product gap that hurts a specific type of user: teams that work on the go.

Now you can build a specific play around it. When a prospect mentions they have a distributed or field-based team, your reps know exactly what to do. They can pivot the conversation with a simple, confident question.

"A lot of teams we talk to get frustrated when their tools don't perform well for reps out in the field. How critical is a smooth and reliable mobile experience for your team's workflow?"

Notice you're not even mentioning ProjectFlow by name. You're using their weakness to frame the conversation around one of your strengths, making your solution the obvious choice for that prospect's specific pain point.

Deconstruct Their Case Studies to Find Who They Really Sell To

Your competitor’s case studies are a roadmap to their best customers. They are literally telling you who they believe their Ideal Customer Profile (ICP) is. By analyzing a handful of their success stories, you can paint a clear picture of who they're built for.

Look for the common threads:

- Industry: Are they all focused on e-commerce, or are they all over the map?

- Company Size: Do they mostly feature startups with under 50 employees, or are they chasing enterprise giants?

- Use Case: Are they highlighting how marketing teams use their tool, or is it always about engineering departments?

Let's say your rival, "DataCorp," almost exclusively publishes case studies with Fortune 500 financial institutions. That tells you a ton. Their product, pricing, and sales process are all likely geared toward landing huge, complex enterprise deals. This is a huge advantage for you at every stage of the https://saasdatabase.net/b-2-b-saas-sales-funnel/.

This intel gives you a clear lane to operate in. You can confidently go after mid-market tech companies, knowing that DataCorp's solution is probably too heavy and expensive for them. You're not just selling; you're strategically targeting the customers they ignore.

Put It All Together with Sales Battle Cards

All this great analysis is useless if it's stuck in a spreadsheet. It needs to be distilled into a format that's instantly available and easy to digest during a live sales call. That's where a good sales battle card comes in. Think of it as a one-page cheat sheet for positioning against a specific competitor.

A great battle card isn't a novel. It's a quick-reference guide that’s scannable and packed with practical talking points.

Here’s a simple but powerful template you can use:

| Category | Details & Talking Points |

|---|---|

| Our Key Differentiators | Stick to 2-3 unique value props. Example: "We offer 24/7 live support; they only offer email." |

| Their Common Weaknesses | The recurring pains from reviews. Example: "Users report slow performance with large datasets." |

| Pricing & Discounting Traps | Things to watch out for. Example: "They often quote a low price but have huge implementation fees." |

| Landmine Questions to Ask | Questions that expose their gaps. Example: "How does your platform handle mobile syncing for field teams?" |

| Who They Usually Win | Where they are strong. Example: "Best for enterprise finance teams with long implementation timelines." |

These battle cards should live right inside your CRM or central knowledge base, where a rep can pull one up with a single click. By equipping your team with these distilled insights, you’re giving them the strategy and confidence they need to navigate tough competitive conversations and bring home more wins.

Weaving Intel into Your Daily Sales Rhythm

If your competitive intel just sits in a folder somewhere, it’s worthless. To actually make a difference, it needs to be part of your team's daily life—not just another chore on their list.

The trick is to weave the practice of gathering and using this intel into the natural flow of your sales team's day. When you get this right, your CI program becomes a living, breathing thing that gets smarter with every single call your team makes. It's all about building simple habits that make sharing what you know second nature.

Make It a Team Ritual

One of the easiest wins is to make competitive intel a standing item in your regular team meetings. Don't just stick to pipeline and quota reviews. Carve out a small but dedicated slice of your weekly sales huddle to talk about the competition.

This small change creates a space where everyone is expected to contribute, turning a solo activity into a team sport.

- Kick off with a "Competitor Corner": Start every weekly meeting with a five-minute lightning round. Go around the room and ask each rep, "What's one thing you heard about a competitor this week?" Maybe a prospect mentioned a competitor's pricing was way off, or they dropped a hint about a new feature on the horizon.

- Spotlight a "Competitive Win of the Week": Find a deal that was won because the rep outmaneuvered a competitor. Have them tell the story. How did they use a key piece of intel—like a known weakness in the competitor's product—to steer the conversation and get the signature?

These little routines send a clear message: we value this information, and we expect you to be listening for it.

Competitive intelligence isn't one person's job. When you create a forum for sharing, every single sales rep becomes a sensor on the front lines, feeding crucial, real-world information back to the entire team.

Build It Directly into Your CRM

Your CRM is the heart of your sales operation. If you want a behavior to stick, the best way to do it is to build it right into the tool your team uses all day, every day.

Don't let valuable intel from a sales call just disappear into thin air. Add a couple of simple, mandatory fields into your CRM workflow.

For example, when a deal moves to the proposal stage, make it a required step to select the primary competitor from a dropdown list. Over time, that one simple action will paint a crystal-clear picture of who you're really up against and where. You can also add a "Competitor Notes" text box to capture the raw, unfiltered feedback prospects share.

Suddenly, your CRM isn't just a system of record. It's your living, breathing competitive intel database.

Create a Constant Feedback Loop

The best CI programs are a two-way street. It’s not about product marketing just pushing battle cards down from on high. It’s about creating a system where reps are actively encouraged—and even rewarded—for sending real-world insights back up the chain.

Let's face it: your reps are your best source of on-the-ground intel. They're the ones hearing the unvarnished truth from prospects day in and day out. This shift is happening everywhere; teams dedicated to competitive intelligence have grown by 24% recently, which shows just how seriously companies are taking this. You can see more on this in the latest competitive intelligence trends.

To get this loop going, create a dedicated Slack channel—something like #competitor-intel—where reps can drop quick notes and screenshots. And when a rep shares a nugget that helps someone else win a deal? Shout it from the rooftops! Publicly celebrate that contribution.

That kind of positive reinforcement does two things: it makes others want to share, and it gives everyone a sense of ownership. When your reps see their feedback being used to update the official battle cards, they become truly invested in the whole process.

Answering Your Top Questions About Competitive Intel

When I talk to sales leaders about setting up a competitive intelligence program, the same practical questions always pop up. They want to know how to get started without derailing their team or spending a fortune. Let's tackle those common hurdles head-on.

"How Much Time Should My Reps Actually Spend on This?"

This is the big one. And the answer isn't about blocking out huge chunks of time for research. It's about building small, consistent habits.

A rep who spends 5-10 minutes every morning scanning alerts from your monitoring tools is going to be far more effective than someone who binge-researches for two hours once a month. Add another 15-20 minutes for a deeper dive during their weekly prep, and you’ve got a system that works without pulling them away from what they do best: selling.

Think of it less like a research project and more like a daily briefing. It’s about staying sharp and informed through small, compounding efforts, not getting bogged down in analysis.

"With So Much Data, What's the Most Important Intel to Track?"

It's easy to get lost in the weeds. If you're just starting out, zero in on the two things that will give your sales team the most immediate firepower in conversations.

- Pricing and Packaging Shifts: Did a competitor just launch a new pricing tier? Are they running a steep discount? This is pure gold for your team. It directly impacts negotiations and helps you get ahead of aggressive tactics before they kill a deal.

- Their Customers' Pain Points: The best intel often comes straight from your competitor’s own customers. Make a habit of scanning review sites like G2 and Capterra for recurring complaints. These frustrations are the perfect ingredients for crafting talking points that frame your solution as the obvious answer.

Nailing these two areas helps your reps hit prospects where it matters most—their wallet and their biggest headaches.

"Can We Do This Without Shelling Out for Expensive Tools?"

Absolutely. Don't let a tight budget be an excuse. While fancy platforms can automate a lot, you can build an incredibly effective program with tools that cost you nothing.

Here’s a simple, no-budget starter pack:

- Set up Google Alerts: Create alerts for every major competitor and key industry terms. It's your free, 24/7 listening post.

- Follow Key People on LinkedIn: Track product marketers, sales leaders, and execs at rival companies. You'll see their messaging and get a feel for their strategic direction.

- Scan G2 and Capterra Manually: Get in the habit of checking for new reviews, especially the negative ones. That's where you'll find your competitive edge.

- Master Win/Loss Analysis: After every competitive deal, dig into why you won or lost. This feedback loop is priceless. As you get better at winning these deals, you'll see a direct improvement in your SaaS customer acquisition cost.

This foundation alone will give you a remarkable amount of actionable intel without touching your budget.

"How Do We Make Sure Our Reps Actually Use This Stuff?"

This is the million-dollar question. The most brilliant intel is worthless if it just collects dust in a shared drive. The secret is to make it dead simple to find and impossible to ignore.

Integrate it directly into your team's daily life. Create simple, scannable battle cards for your top five competitors and put them right inside your CRM or sales playbook.

But the real key? Talk about it constantly. Bring up competitive wins and new intel in every single team meeting. Once reps see their peers using intel to close deals and hit their number, adoption will take care of itself.